Investors looking to participate in the various ISO administered annual and monthly FTR auctions must navigate a complex landscape of shifting policy and grid topology. Of note for ERCOT market participants is the recent Texas PUC approval of a performance credit mechanism, a major market reform over continued reliability concerns that will go before the state’s legislature this spring.

Adding even more complexity to most U.S. markets in 2023 is the unstoppable force of renewable energy and related infrastructure. This includes a 10% increase in the investment tax credit (ITC) for wind and solar projects built within specific energy communities and up to a 20% ITC increase for Environmental Justice Areas, as defined in the Inflation Reduction Act (IRA).

Whether trading, hedging, or a blend of both, market participants must shape their view of how systems and topology are changing with a complex array of data and analytical tools. To confidently bid and succeed in FTR auctions requires a rigorous methodology to track market events like outages inform FTR positions, trades, and risk strategies accurately.

In this e-book, we will summarize some of the important factors FTR traders will need to review as they prepare for the FTR auctions and the considerations that need to be made:

As wind and solar capacity expand across U.S. power markets, weather has become one of the most important variables influencing grid conditions and market dynamics. For FTR traders, accurately anticipating how weather will impact load, generation and congestion is critical to building resilient, profitable strategies.

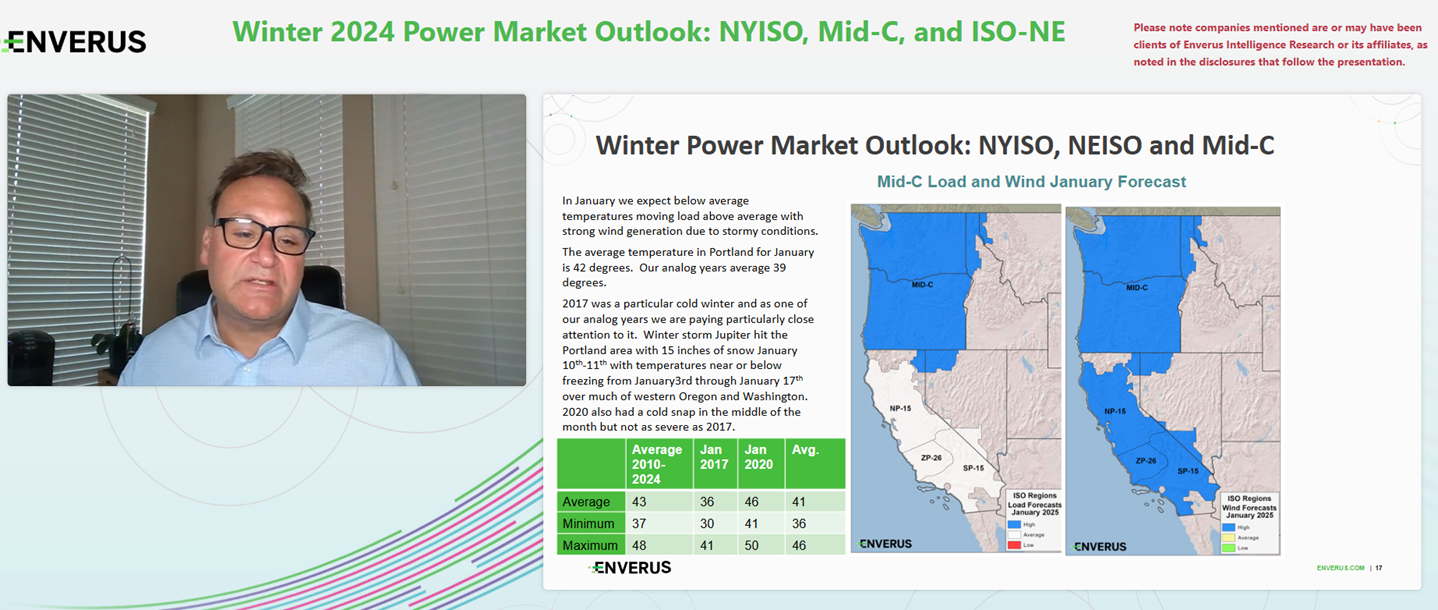

Weather drives fluctuations in both electricity demand and renewable supply. Temperature swings alter heating and cooling load, while wind and solar generation are highly sensitive to atmospheric conditions. Traders who understand these relationships can better anticipate which transmission paths may become constrained under specific weather scenarios—particularly during extreme events.

Analyzing historical analog years with similar weather patterns offers a valuable starting point. By comparing past market behavior during years with comparable conditions, traders can identify which paths bound and how the grid responded. However, this analysis must be adjusted for any recent infrastructure changes that could alter flow patterns.

Seasonal and sub-seasonal forecasts also help traders prepare for longer-term trends. Ocean-atmosphere systems like El Niño or La Niña can cause persistent weather anomalies that influence regional power markets for months. For example, El Niño may bring wetter, milder winters to some areas and drier, hotter conditions to others—each with unique impacts on load and generation. Understanding these patterns and their timing allows traders to better predict how congestion and pricing may shift heading into an FTR auction.

Drought conditions are another critical weather factor, particularly in regions reliant on hydro or thermal generation. High temperatures and low water availability can reduce generation capacity while increasing demand, creating unexpected congestion and price volatility.

To effectively navigate these risks, FTR traders can combine historical climate data, seasonal forecasts, and localized weather analytics to develop a forward-looking view of the grid. When paired with simulations and nodal-level modeling, this approach allows traders to evaluate risk more precisely and optimize their auction strategies. In an increasingly weather-sensitive grid, mastering the interplay between meteorology and market behavior is key to maintaining an edge in FTR markets.

Demand refers to the amount of electricity that consumers need from the power grid at any given time. Understanding an area’s demand is important because it sets expectations for power prices and identifies potential areas where the power infrastructure may not be able to support the demand.

To predict where these potential areas may occur, it is helpful to investigate the expected growth in future load demand in an area, particularly if there are significant increases in demand. Rapid population or industrial growth, as well as the introduction of Bitcoin and rig operators, can result in significant increases in load demand.

It is also important to consider when these demand spikes will occur. For example, Bitcoin miners and some manufacturers require electricity 24/7, which can affect off-peak hours more than morning or evening peaks. Power operators must adjust their operations to meet these changing demands.

Analyzing past or recent constraints can provide valuable insights and guide future efforts to identify paths that may become constrained. To determine potential paths of interest, it is important to understand the underlying drivers of these constraints and predict whether they will persist in the future. Commercial diagnostic tools are available to aid in identifying the causes of constraints and building a case for their potential continuation.

After identifying a constraint driver, it is possible to use constraint analysis tools to simulate different scenarios and assess their impact on the affected paths. For instance, weather scenarios such as high or low wind, cold or hot temperatures can be inputted into the analysis tool to model the grid and identify potential paths that may become constrained. However, running these types of scenarios can be time consuming, and it is advisable to use automated constraint analysis tools to accelerate the process. These tools can significantly reduce analysis time, allowing users to examine hundreds of constraints in just a few minutes and focus on the most interesting paths.

Gaining insight into transmission plans and anticipated outages enables FTR traders to pinpoint areas at higher risk of congestion—guiding deeper analysis and more strategic position planning.

Reports on transmission and generation outages provide valuable information on upcoming maintenance that will impact generation and paths on the grid. Reviewing and understanding these reports can help identify paths with a high likelihood of becoming constrained.

Users can dig into these reports and check historically how these same outages have impacted the grid and which paths had been bound. Tools are readily available on the market that simulate the effects of transmission or generator outages on the grid, helping uncover potential paths that bind.

These simulations can be tedious, so it is recommended to use automated tools that can help reduce analysis time, sometimes by tenfold, so that the focus can be on preparing trades instead of analysis.

As new generation projects come online, particularly renewables and energy storage, and large load centers like data centers and crypto mining operations ramp up, the grid faces mounting pressure. At the same time, retiring generation and aging transmission infrastructure introduce additional uncertainty into how power will flow across the network. FTR traders who overlook these evolving dynamics risk misjudging congestion patterns, leading to costly misallocations of capital and missed revenue opportunities.

To stay ahead, traders need visibility into both planned and retiring generation, transmission buildouts, and upcoming load additions. By analyzing these projects and their placement in interconnection queues, traders can gain critical foresight into how the grid will shift. This includes identifying where congestion risks are most likely to emerge, especially as transmission constraints tighten in areas of rapid change. Scenario modeling and advanced simulations provide a faster, more granular understanding of future grid behavior, while evaluating transfer capability at key points of interconnection helps traders anticipate bottlenecks. Armed with these insights, traders can refine FTR strategies to capitalize on change and minimize risk in an increasingly dynamic market.

Tracking delays in generation, load, or transmission projects helps FTR traders anticipate when key changes to the grid may actually occur—improving the timing and accuracy of congestion forecasts.

When power projects are delayed, power that was expected to come online will be later than originally anticipated. As a result, positions that were based on those original timelines will need to be adjusted. Staying informed about the latest updates on power project timelines can provide an opportunity for traders to adjust and capitalize on the new projected start date.

Navigating today’s power markets is increasingly complex, especially as renewable penetration grows, regulatory frameworks shift and grid constraints evolve unpredictably. Traders face the challenge of making informed decisions in environments where local dynamics—like nodal pricing, congestion patterns and interconnection bottlenecks—can vary dramatically across regions. Without deep market insight, even experienced professionals risk misjudging value, timing or exposure. That’s where access to veteran power analysts becomes a game-changer. Their real-time commentary and expert interpretations provide critical context behind market movements, helping traders uncover hidden risks, identify emerging opportunities and gain clarity in the regions they’re active in—or looking to enter. This seasoned perspective enables more confident, data-informed decisions in fast-moving and opaque power markets.

Want to learn more about how to prepare for FTR auctions? Listen to our experts on how they evaluate new capacity, track key projects, leverage wind and solar forecasts, and decompose constraint drivers to successfully navigate FTR auctions.

Let’s get started!

Let’s get started!

We’ll follow up right away to show you a quick product tour.

Ready to Subscribe?

Ready to Get Started?

Ready to Subscribe?

Sign Up

Power Your Insights