Outage season is a critical and complex period for power asset management, when planned disruptions for maintenance, infrastructure upgrades and refueling of generation assets disrupt grid stability. Grid outage reductions in coal generation capacity increase electricity price volatility (measured via realized variance of hourly wholesale prices) by up to 12% during peak outage periods in markets like ERCOT and MISO, according to regression analysis.¹ This heightened volatility creates operational challenges and financial risks, demanding precise navigation to avoid losses and seize market opportunities. For asset managers, mastering outage season requires advanced forecasting, scenario modeling and real-time analytics to optimize dispatch decisions, mitigate congestion risks and maximize portfolio profitability across ISOs like MISO, PJM and CAISO.

This guide provides a comprehensive playbook to empower asset managers with the tools and insights needed to transform outage season’s complexities into opportunities for enhanced performance and sustained returns.

Outage season, occurring during the shoulder months of spring and fall, is when grid operators schedule planned outages for generation and transmission assets, strategically timed between the high-demand periods of summer cooling and winter heating to minimize reliability risks, yet leaving the grid with reduced redundancy and heightened fragility despite lower net demand. This limited flexibility, resulting from taking transmission lines or generation units offline, disrupts normal power flows and dispatch patterns, often leading to congestion and significant price swings triggered by minor deviations in load or renewable output, such as an unexpected demand spike from a cold front or a sudden drop in wind generation.

Regional variations add further complexity to outage planning and operations. For example, ERCOT schedules most planned outages during the shoulder seasons (fall and spring) to avoid peak summer and winter demand, while CAISO coordinates maintenance around Northwest hydro flows and seasonal wind patterns. Meanwhile, PJM and MISO focus their outage windows on fall and spring to prepare for peak winter heating loads, minimizing risks during high-demand periods.

Traditional power forecasting methods—particularly those based on historical regression—often fall short during outage season. These models assume that tomorrow will look much like yesterday, relying on historical correlations that may no longer hold. But during outage season, the grid is in constant flux. Outages, weather anomalies and market rule changes can all render historical patterns obsolete.

Regression models are particularly vulnerable to structural changes. For instance, if a new transmission constraint is introduced to manage stability in a growing load pocket, historical price relationships may break down. A model trained on last year’s data won’t account for this new constraint, leading to inaccurate forecasts and poor trading decisions.

To address this challenge, leading firms are turning to simulation-based power forecasting. These models use power flow simulations to predict the future state of the grid, incorporating planned outages, weather forecasts and unit statuses. Unlike regression models, which offer a single deterministic forecast, simulation-based models provide a range of possible outcomes, reflecting the inherent uncertainty of the system.

Simulation-based forecasting, which models the actual constraints and rules of the grid during outage season, equips asset managers and grid operators with a robust tool to navigate the volatility and reduced redundancy of spring and fall grid operations. Below is the value of simulation-based forecasts:

To illustrate with a plausible scenario, consider an asset manager in MISO during the October outage season, facing a planned transmission line outage in Illinois. Using simulation-based forecasting, they accurately predict a congestion-driven price spike due to a forecasted wind lull in the Dakotas and a cold front increasing demand. By modeling these interdependencies, they proactively secure alternative power sources, hedge against price volatility and strategically bid in the market, maximizing profits. This example illustrates how simulation-based forecasting’s precision, risk mitigation and adaptive modeling empower confident, profitable decisions, transforming outage season’s challenges into opportunities for success in a volatile grid environment.

Weather plays a pivotal role in outage season, amplifying both risk and opportunity. It affects load, renewable generation and even transmission flows. Understanding weather patterns—and integrating them into forecasting models—is essential for effective power asset management.

Climate drivers such as the El Niño–Southern Oscillation (ENSO) can have far-reaching effects. Transitions between El Niño and La Niña influence wind patterns, storm frequency and temperature anomalies across the country. October is often a swing month, with potential for both heat and cold, as well as residual hurricane threats in the Gulf. November typically brings muted storms and lower wind in central and southern regions, increasing the risk of congestion. December can feature sharp cold snaps and wintry tail events that spike demand and stress the grid.

Consider a scenario in MISO where a sudden cold front drives up morning heating demand while solar output remains low due to cloud cover. If several gas units are offline for maintenance, the system may rely heavily on imports or peaking units, driving up prices and increasing congestion. Without accurate weather forecasting and scenario modeling, asset managers may miss these opportunities—or worse, expose themselves to unnecessary risk.

To navigate these risks, asset managers must use ensemble weather models that capture a range of outcomes. Monitoring temperature deviations, wind anomalies and storm development is critical. By integrating these forecasts into power flow simulations, managers can anticipate extreme events and hedge accordingly.

One of the most powerful tools available during outage season is scenario modeling. Rather than relying on a single forecast, scenario modeling explores a range of possible outcomes, each reflecting different assumptions about load, generation and system conditions.

This approach offers several key benefits. It helps identify downside risks, such as price collapses due to over-forecasted load or unexpected renewable surges. It also highlights upside opportunities, such as scarcity pricing triggered by under-forecasted demand or surprise outages. By modeling each asset independently, scenario modeling avoids the pitfalls of hub-based interpolation and provides a more accurate picture of node-level risk.

Scenario modeling also supports real-time decision-making. As new data becomes available throughout the day, forecasts can be updated and positions adjusted. This agility is essential in a market where conditions can change rapidly and without warning.

For example, a base case forecast may show stable prices, but a P-75 scenario (75th percentile) might reveal a risk of price dips during the morning ramp due to overestimated net load. This insight allows traders to hedge more effectively or position for upside. Similarly, a P-90 scenario might highlight the potential for scarcity pricing if wind underperforms and a key transmission line remains offline.

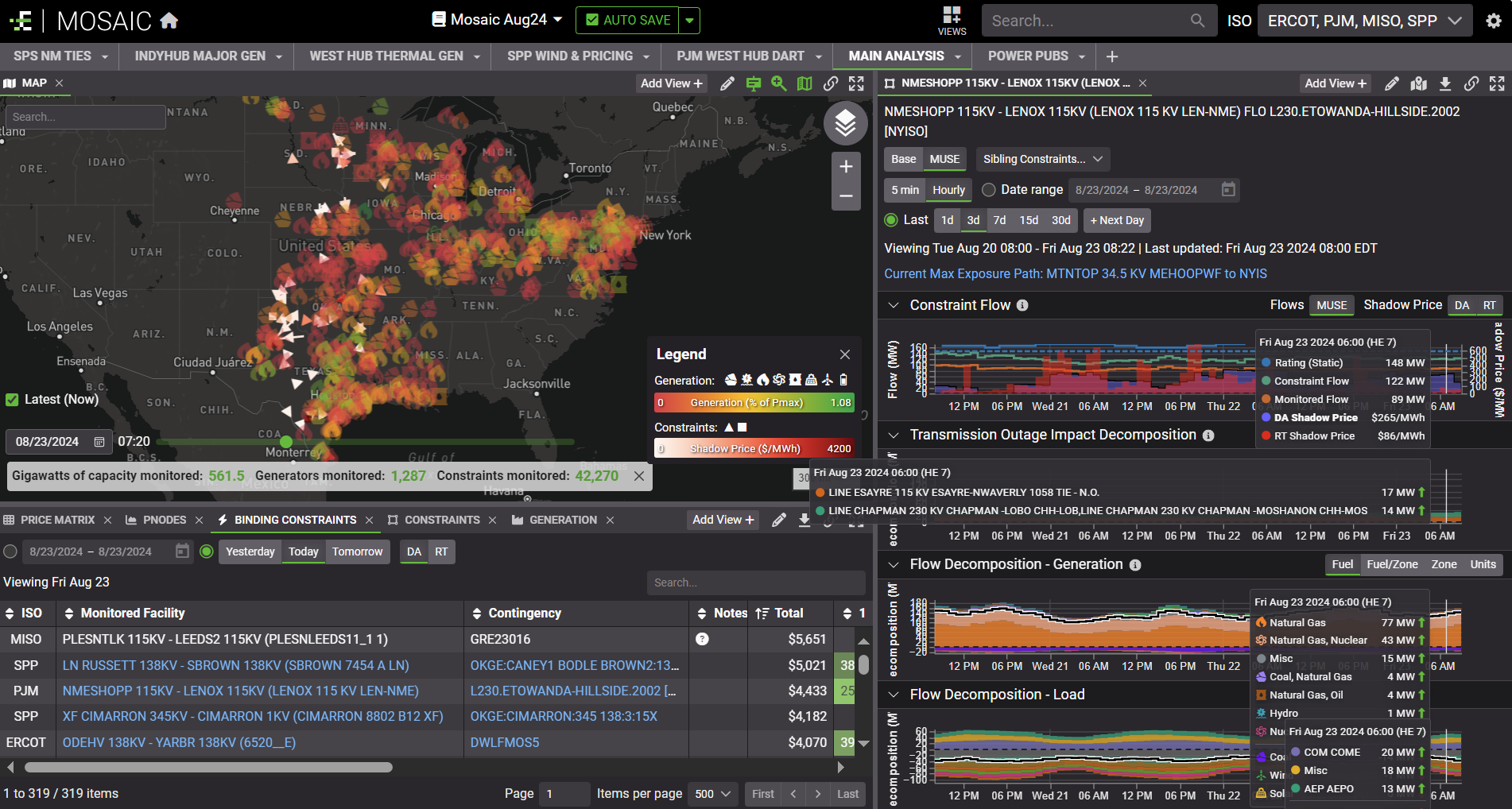

During outage season, when planned outages for generation and transmission assets reduce grid redundancy and drive volatility, power asset managers rely on integrated market intelligence and advanced tools to transform simulation-based forecasts into strategies that optimize asset performance and maximize portfolio profitability. Daily power market publications deliver critical insights, summarizing generation trips, binding constraints and price anomalies, while providing short-term load and renewable forecasts with expert commentary to identify risks to assets and opportunities for profit. Longer-term 90-day outlooks highlight upcoming transmission outages and potential constraints, enabling asset managers to structure financial transmission rights (FTR) positions that protect portfolio value, seamlessly integrated with forecasting platforms to translate insights into actionable asset strategies.

Real-time monitoring tools track thousands of constraints and generators, providing live data on locational marginal prices (LMPs) and constraint flows to guide asset dispatch decisions. Price decomposition reveals how specific constraints impact node prices, allowing managers to optimize assets by targeting high-value nodes. Outage tracking links transmission outages to congestion risks, while constraint forecasting predicts binding nodes, such as a PJM interface strained by morning heating demand and low solar output, enabling proactive adjustments to asset operations.

Advanced forecasting tools enhance portfolio management by anticipating grid dynamics with precision. Nodal renewable forecasts, leveraging physics-based models with turbine-level data and solar irradiance, predict wind and solar output shifts at specific assets, helping identify where there might be excess generation that could result in congestion. Synthetic price forecasts, combining machine learning with outage schedules and weather inputs, deliver accurate day-ahead price predictions, helping managers position assets to capture price spikes. Flexible platforms with APIs support custom analytics, allowing managers to tailor strategies across ISOs for diverse portfolios.

For example, in MISO’s October outage season, an asset manager uses real-time simulations and daily publications to predict a congestion-driven price spike from a transmission outage in Illinois and a wind lull in the Dakotas. By adjusting dispatch to prioritize unaffected assets and securing alternative power sources, they achieve significant cost savings and boost portfolio returns, demonstrating how these tools leverage simulation-based forecasting’s precision, risk mitigation and profitability to empower asset managers to navigate outage season’s challenges with confidence.

As outage season looms, managing your power assets grows increasingly complex. With rising renewable generation and frequent transmission outages fueling congestion risks and market volatility, are you ready to optimize your portfolio with confidence?

Join our 45-minute webinar, “Managing Power Assets During Outage Season,” to learn actionable strategies for tackling these challenges using MOSAIC by Enverus, the leading short-term power analytics and forecasting solution. Hosted by industry experts Eric Palmer and Scott Bruns, this session will arm you with the insights and workflows needed to stay ahead.

Outage season’s volatility, driven by planned generation and transmission outages, demands a strategic approach to portfolio management, enabling power asset managers to optimize asset performance, mitigate risks and maximize profitability across multiple time horizons and ISOs. By leveraging simulation-based forecasting and advanced tools, asset managers align short-term operations with long-term strategies to ensure portfolio resilience in a fragile grid environment.

Asset managers use real-time forecasts and nodal analytics to optimize dispatch decisions, ensuring assets like wind farms or gas units operate at peak profitability. Nodal renewable forecasts predict output shifts, allowing managers to prioritize high-performing assets and capture elevated LMPs during congestion-heavy periods. Real-time monitoring of thousands of constraints identifies high-value nodes, enabling precise asset positioning to boost portfolio returns significantly.

Mitigating outage season risks requires proactive strategies, such as securing FTRs to hedge against congestion-driven price volatility. Constraint forecasting tools predict binding nodes, enabling portfolio adjustments to avoid losses. Scenario modeling explores downside risks, like price collapses from over-forecasted load, allowing managers to secure alternative power sources and protect portfolio value with substantial cost savings.

Long-term 90-day outlooks guide asset managers in structuring FTRs and bilateral contracts months in advance, locking in favorable pricing. By anticipating transmission outages and renewable variability, managers align strategies with market trends across ISOs like MISO or CAISO. Flexible platforms with APIs enable custom analytics, tailoring long-term plans to diverse portfolios for sustained profitability.

For example, in MISO’s October outage season, an asset manager can leverage 90-day outlooks and constraint forecasting to anticipate a transmission outage causing congestion. By securing FTRs and optimizing dispatch to prioritize unaffected assets, they achieve significant cost savings and enhance portfolio returns, demonstrating how integrated analytics and strategic planning empower asset managers to navigate outage season’s complexities with confidence.

Outage season’s volatility challenges power asset management to optimize performance and maximize portfolio profitability amidst planned outages and grid fragility. Simulation-based forecasting, scenario modeling and integrated tools empower managers to anticipate congestion, optimize dispatch and secure FTRs, achieving significant cost savings and enhanced returns. These strategies enable precise, confident decisions across the ISOs, transforming risks into opportunities. Leverage advanced forecasting and analytics tools to drive asset performance, mitigate volatility and ensure sustained portfolio profitability, thriving in outage season’s complex grid environment.

With a 15-year head start in renewables and grid intelligence, real-time grid optimization to the node and unparalleled expertise in load forecasting that has outperformed the ISO forecasts, Enverus Power and Renewables is uniquely positioned to support all power insight needs and data driven decision making. More than 6,000 businesses, including 1,000+ in electric power markets, rely on our solutions daily.

Enverus Short-Term Grid Analytics and Forecasting Solutions empower power traders, utilities and asset owners with real-time insights and industry-leading accuracy. Boasting a 25-year track record of outperforming ISO load forecasts, our platform delivers actionable intelligence 75% faster through 2x plant monitoring, sub-hourly farm-level forecasts and real-time constraint decomposition. By integrating expert analyst reports and ISO data, Enverus transforms grid volatility into strategic opportunities for precise, profitable decisions.

Enverus Mid-Term Power Forecasting Solutions deliver 120-day hourly nodal wind, solar and load forecasts, enabling traders and asset managers to identify grid opportunities and risks 10x faster. With Panorama’s powerflow engine, Radar’s automated outage analysis, ATC for interconnection insights and instant constraint decomposition, the platform integrates expert analyst reports and one-click cost modeling to maximize asset value and drive precise, profitable decisions.

Advanced grid insights with accurate load forecasts and extensive monitoring enhance trade execution and profitability.

Quickly identify grid opportunities and risks with high-quality mid-term forecasts, expert analysis and streamlined grid analysis.

Confidently shape your investment strategy, identify optimal power asset locations and optimize utility scale PV project profitability—all in minutes.

With Enverus Instant Analyst™, you receive answers you can trust, delivered in seconds. Sourcing from 25+ years of vetted data and research on the most trusted SaaS platform designed exclusively for energy.

Confidently shape your investment strategy, identify optimal power asset locations and optimize utility scale PV project profitability—all in minutes.

Arm yourself with the knowledge to inform strategic decisions and grow your business with one source for insights across oil and gas, renewables, carbon capture and ESG.

Design PV Plants & Battery Storage Systems 90% Faster with Our Advanced Solar & Battery Software.

SUGAR™ helps grid operators and utilities manage increasing interconnection queue volumes by accelerating modeling and simulation studies, with up to 2x reduction in time-consuming study processes.

Unlock returns of electron and molecule-based energy transition technologies with deal insights, from power generation assets to CCUS and hydrogen.

Tune out the noise, get unbiased evaluations and uncover hidden opportunities with advice you can trust from experienced energy and power intelligence advisors.

Comprehensive coverage of power markets and insights into emerging energy technologies and project economics.

Interconnect offers developers certainty throughout the interconnection lifecycle, providing scenario analysis and risk assessment capabilities to improve the chances of deploying new projects.

Let’s get started!

Let’s get started!

We’ll follow up right away to show you a quick product tour.

Ready to Subscribe?

Ready to Get Started?

Ready to Subscribe?

Sign Up

Power Your Insights