With the Omicron variant continuing to spread around the world, will a drop in oil prices follow? Maybe, but probably short term.

Equity markets tanked last Friday, Nov. 26, on fears that the Omicron variant would sharply impact worldwide economic output. The nearly 1,000-point loss in the Dow wiped nearly $90 billion of value in Dow equities. Oil prices were particularly hit hard, dropping nearly 10% from Thursday’s close.

That drop, however, is minor compared to what happened to prices in early 2020 when at the end of April oil prices had dropped nearly 70% in value. This was frightening and was a combined pessimistic response to fears of demand destruction due to coronavirus and the price war initiated by OPEC and Russia to counter rising production from U.S. shale oil producers.

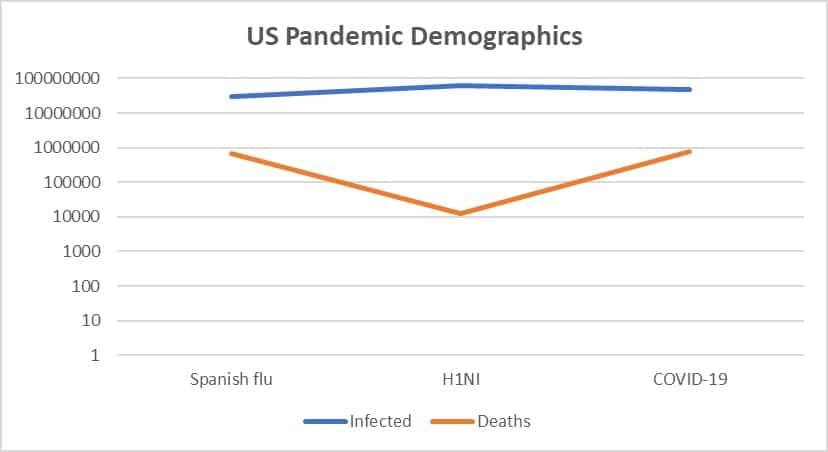

As a world economy, we had not faced a major health crisis since 2014 when Ebola fears gripped the world and, according to the Centers for Disease Control and Prevention (CDC), the 2009 H1N1 flu sickened 60.8 million and killed 12,469 in the U.S.

If we go back to the 1918 Spanish flu, the graph below shows the gross U.S. demographic impact of these pandemics.

The 1918 Spanish flu infected about 28% of the U.S. population but didn’t impact oil prices to any great degree. COVID-19 has infected about 15% of our fellow citizens but has caused nearly 125,000 more deaths because our population is about three times larger than it was in 1918.

In our current COVID-19 pandemic, images of first responders desperately improvising to save lives, and stories of grief-stricken children and partners forced to provide remote comfort to isolated and suffering elders tested our confidence that there would ever be a “normal” American life in the future.

How did oil markets react?

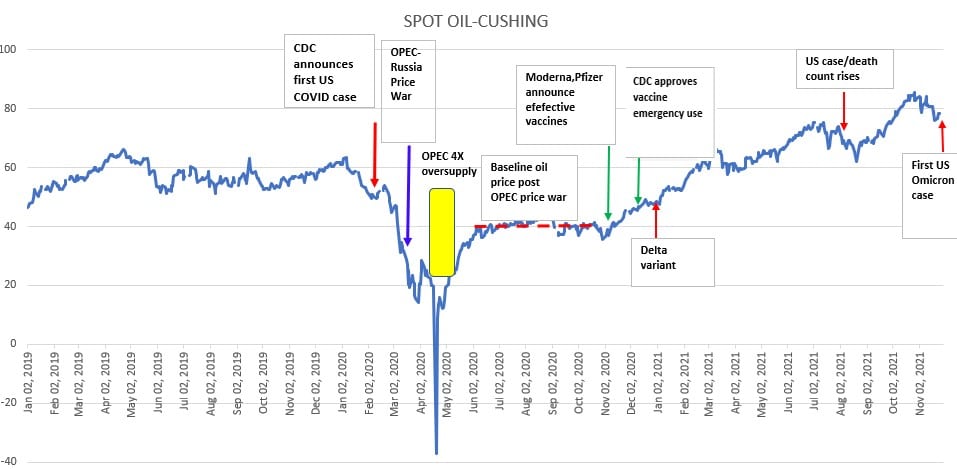

The pre-COVID price of oil (CLF) in late 2019 dropped by 73% to its low in April 2020. Fears of demand destruction due to COVID dropped the price from $63/bbl to around $40/bbl — a 36% drop.

Price pressure was further exacerbated by OPEC’s price war with Russia, with OPEC increasing their output by a factor of four during a short window going into and lasting through April 2020. This dropped the price of oil another 40-50%.

Once OPEC ended its price war, the baseline price of oil was around $40/bbl.

When Moderna and Pfizer announced their vaccines, and the CDC authorized their emergency use, prices recovered until late July 2021 when the U.S. entered its third wave of increasing case counts and rising death counts.

Prices dropped about 16% before staging an astounding recovery to a four-year high of nearly $84/bbl in mid-October.

Now we have the Omicron variant. We do not have enough information yet about its transmissibility or lethality, but the market’s virus fears resulted in a drop from $74/bbl on its Nov. 26 opening to midday pricing of $65/bbl on Nov. 30 — a three-trading day drop of about 12%.

Our first pandemic oil price drop occurred when nothing about the potential impact of COVID, or treatments for it, was known. If we were in the same state of unpreparedness now, we could see the previous pandemic fear factor of 36% drop the price from here to the low $50/bbl, high $40/bbl range.

However, given that we have vaccines, monoclonal antibodies, new therapies and better testing, my guess is that our original fear discount won’t apply now, and that we would see some, but not a lot, of price weakness from here.

The bigger fear would be that planned incremental OPEC production increases would increase supply and range bind prices. Given that the recent OPEC-Russia price war dropped prices about 50%, supply increases do more to depress prices than virus fears.

As is always the case with oil prices, tomorrow always delivers surprises.