Vistra (VST) is wasting no time in 2026, positioning itself as a highly viable solution to the grid’s “reliability gap.” By acquiring 5.5 GW of dispatchable gas assets via a $4.7B Cogentrix deal, VST has secured its spot in constrained markets like PJM and ISO-NE. These assets act as the necessary bridge as data center load growth continues to outpace infrastructure timelines. Simultaneously, VST’s 3 20-year PPAs with META proves that nuclear is the key to cleanly fueling data centers. This deal provides a cumulative 2.6 GW of capacity including uprates, creating long-term revenue certainty needed to extend the life of these carbon-free assets through the 2050s.

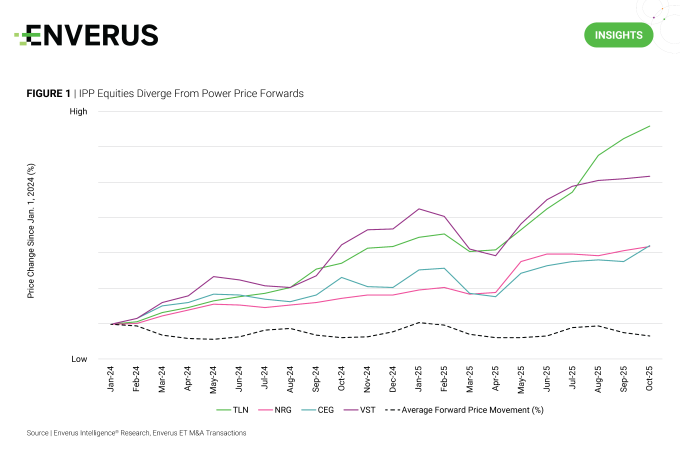

At Enverus Intelligence Research (EIR), we’ve highlighted that IPP equity performance is increasingly decoupled from power prices and is instead often tethered to M&A and hyperscaler offtake visibility (Figure 1). The market agrees: VST saw a 4% jump on the Cogentrix news and a staggering 15% surge following the Meta announcement. This expansion comes just six months after VST’s acquisition of 2.6 GW from Lotus Infrastructure Partners. While the $4.0B net price tag for Cogentrix is twice the absolute cost of their $1.9B Lotus transaction, it implies IPPs are willing to pay a premium to secure dispatchable capacity at scale.

This blog offers just a glimpse of the powerful analysis Energy Transition Research delivers on the trending themes, don’t miss the full picture.

Research Highlights:

- 2026 Global Energy Outlook – Enverus Intelligence® Research’s 2026 outlook for global oil and gas markets, the energy transition space as well as North American and international E&P activity.

- Long-Term Load Forecast – Pushing Peaks – This report encompasses our view on how exponential load drivers will impact our power demand forecasts from 2025-50.

- Biofuel Feedstocks – Go Local To Stay Viable – EIR’s assessment of how recent U.S. policy-driven feedstock restrictions affect biofuel competitiveness and which producers are best positioned to remain resilient.

- Reliability on the Edge – Fast-Tracking the Queue – We examine the market impacts of recent developments in fast-track interconnection processes in SPP, PJM and MISO.

DID YOU KNOW?

Natural gas is completely invisible and odorless. The chemical mercaptan is manually added to give it its signature “rotten egg” scent.

Key Takeaways

Why is Vistra expanding its portfolio with the Cogentrix acquisition?

Vistra is addressing the grid’s growing “reliability gap” by adding 5.5 GW of dispatchable natural gas capacity, securing its position in constrained markets like PJM and ISO-NE and supporting rapid data center load growth that outpaces current infrastructure timelines.

How does the Meta nuclear PPA deal strengthen Vistra’s long‑term value?

Vistra’s three 20‑year PPAs with Meta unlock 2.6 GW of nuclear capacity (including uprates), providing stable revenue through the 2050s and reinforcing nuclear as a key clean‑energy solution for powering hyperscale data centers.

What does Vistra’s stock reaction reveal about current IPP market drivers?

Equity performance for independent power producers (IPPs) is increasingly tied to M&A activity and hyperscaler offtake visibility, evidenced by Vistra’s 4% share bump after the Cogentrix deal and 15% surge following the Meta announcement.

Enverus Intelligence® | Research, Inc. is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts, and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.