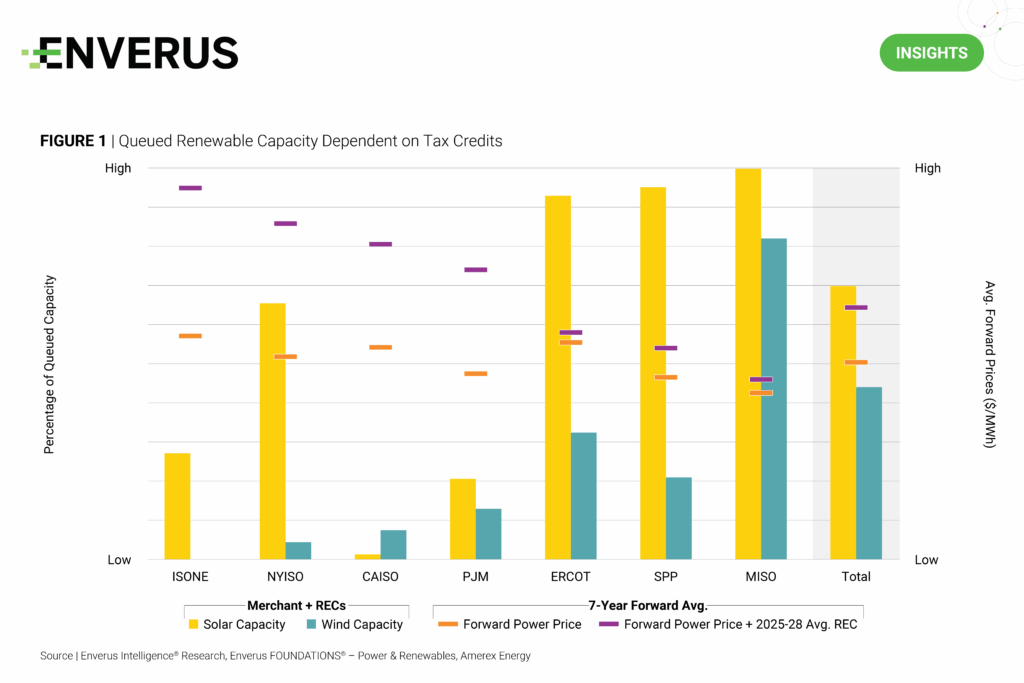

In a move that could upend the U.S. clean energy buildout, the House has passed the “One Big Beautiful Bill” Act—legislation that would gut core Inflation Reduction Act tax credits. Enverus Intelligence® Research (EIR) estimates over 70% of solar PV and more than 40% of onshore wind capacity, totaling 517 GW out of 801 GW of queued capacity, depends on these incentives.

The bill accelerates the phaseout of 45Y and 48E credits by 2028, requiring projects to begin construction within 60 days of enactment and enter service by year-end 2028. Without the credits, much of the queue becomes economically unviable, with solar PV more dependent than onshore wind.

Still, not all regions are equally exposed. In 2024, 45 GW of solar PV and wind came online. Another 284 GW in the queue doesn’t rely on federal incentives—equivalent to over six years of development in 2024’s pace. Of that, 62% of solar is in PJM, while ERCOT, PJM, and SPP lead in tax-credit-independent wind with 21%, 27%, and 27% shares, respectively.

If enacted, the bill could front-load project activity before a sharp drop-off, shifting capital toward regions with stronger standalone economics.

DID YOU KNOW?

Aeroderivative gas turbines used in power plants are adapted from aircraft jet engines. They offer a combination of high efficiency, fast startup times and operational flexibility, and can run on a variety of fuels, including natural gas, hydrogen blends and biofuels.

Highlights From Energy Transition Research

- American Clean Power – Dispatch to Dollars: How Power Market Fundamentals Drive Portfolio Profitability – This presentation to the American Clean Power conference in May unveils a comprehensive production cost model forecasting hourly dispatch, generation and price realizations for every power asset in the U.S. over the next 30 years, driven by detailed supply and demand fundamentals. We reveal how load drivers, such as data centers and new manufacturing facilities, impact market dynamics, shape asset-level profitability and unlock detailed valuations that inform investment decisions.

- Stratos Direct Air Capture – Capturing Carbon, Creating Value – This report provides a full project overview of the largest direct air capture facility in the world. EIR analyzes everything from project timelines, sequestration strategies and reservoir quality to power demand and project economics for OXY’s Stratos facility.

- EVOLVE 2025 – Unlocking Value in Clean Fuels: Strategies for a Resilient Future – The clean fuels industry is at a critical juncture. An influx of low-carbon fuels has put downward pressure on U.S. credit prices, reshaping the economic landscape of the sector. This Enverus EVOLVE 2025 presentation explores how stakeholders can navigate these dynamics and develop more resilient business models to create sustainable value in the face of changing market conditions.

Deal Insights

- Doubling Down on Gas – NRG Doubles Portfolio With $12 Billion LS Power Deal – How does our valuation of NRG’s newly acquired gas assets compare to the acquisition price, and what does it reveal about the shifting need for dispatchable generation in the L48 amid rising demand and power price forecasts?

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. See additional disclosures here.