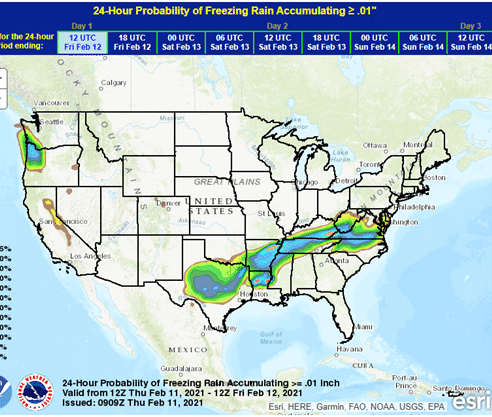

A fast-evolving cold weather system from Canada has cast a major arctic front across the northern, central, and southern plains. The series of storms is expected to hold strength through early next week.

Forecasts predict the potential for record demand in ERCOT and SPP through early next week. Both regions are regularly exceeding their day-ahead forecasts often by several thousands of megawatts-per-hour. Under these stressed conditions, both systems are already seeing reduced Operating Reserves, transmission congestion which results in extreme prices.

ERCOT Looking Back – How Freezing Weather Changed the Markets

This week’s conditions are similar to what happened during the first week of February 2011. During that period, an extreme cold spike led to a sharp increase in demand, several thermal generators tripped offline due to the extreme temperatures, and windfarms capacity was reduced due to icy conditions. This resulted in rolling blackouts, which further compounded the issue as many natural gas compressing stations were left without power and could not supply generators need to recover the system.

The load forecast for February 15-16, 2021, will stretch operating reserves and likely lead to high prices and the potential for extreme volatility. Thankfully, the lessons learned from ten years ago has left the system in a much more proactive and stable situation from a reliability perspective.

Since that time, regulators including the PUCT and ERCOT have worked with generators in ERCOT to ensure that plants have formal cold weather procedures, and additional insulation around critical sensors and areas sensitive to cold temperatures like water supply lines. ERCOT worked transmission providers to ensure that power to natural gas compressing stations are not cut during emergency conditions.

Freezing precipitation is likely to cause wind farm capacity curtailments (derate) as turbines removed from service due to ice buildup on the blades. De-icing systems may not be present on wind turbines units, especially older units. Typically, an onsite inspection is warranted before these turbines are reset. This may hamper efforts to bring that capacity back online as a danger exists to technicians of falling ice sheets and site lockouts are common until temperatures warm.

On February 10, 2021, Enverus reported an increase in wind resource outages in SPP, and the same conditions exists for ERCOT the coming days especially in the North, Panhandle, and upper West Zones along the CREZ lines.

Stay ahead of market volatility with Enverus

Freezing temperatures are hitting the power markets hard as North America preps for historically low temperatures as far south as Texas. We want to help market participants stay ahead of the volatility. Email us at businessdevelopment@enverus.com to qualify for a complimentary trial of Enverus load forecast reports, sent out twice daily.