In today’s energy industry, suppliers face a volatile environment shaped by shifting oil prices, shifting tariffs, and increased merger and acquisition (M&A) activity. These trends make for an uncertain landscape, but they also open the door to significant opportunities as global energy usage is projected to rise in the decades ahead.

For example, in 2024, the energy sector saw more than $400 billion in acquisitions—a three-year high (Bain & Company). At the same time, petrochemicals are expected to account for more than one-third of oil demand growth by 2030 and nearly half by 2050 (International Energy Agency). The opportunity is clear: suppliers that are financially prepared will be positioned to grow, even amid volatility.

One of the most overlooked yet powerful levers for achieving that preparedness is how you manage accounts receivable (AR).

The Problem With Traditional AR

Traditional AR processes weaken cash management by slowing down the entire cycle. They often require suppliers to enter invoices twice—once into internal accounting software and again into buyer invoicing platforms—introducing the risk of errors. These errors lead to invoice disputes, which delay approval times and stretch already long payment cycles. Oftentimes these errors are only small formatting discrepancies.

Meanwhile, staff must spend countless hours re-submitting invoices and troubleshooting errors, leading to inefficiency and sometimes the need for additional headcount. Combined with long net terms of 30, 60 or even 90 days, cash flow slows to a crawl—leaving suppliers unprepared for both challenges and opportunities.

Why Strong Cash Management Matters

Maintaining a healthy working capital position enables suppliers to take on large projects that drive growth, while also covering payroll and other operational expenses with confidence during industry slowdowns, market shifts or off-season periods. It reduces the need to turn to banks when suppliers need funding quickly; in such situations they often face lengthy approval processes, high rejection rates and time spent on paperwork. Strong cash management is not just about survival; it’s about ensuring the agility to move when it matters most.

How Innovative Oilfield Suppliers Streamline AR

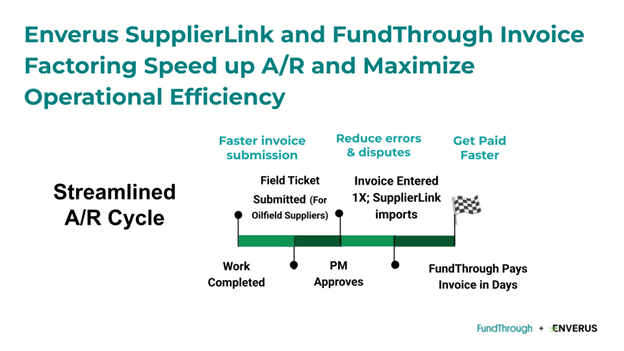

The key to unlocking cash flow is transforming the AR process by streamlining it. This begins with eliminating double entry of invoices, which reduces errors and frees up staff time. It also means submitting invoices to customers sooner, so the approval process starts right away. Finally, getting paid as soon as invoices are approved effectively eliminates net terms altogether. Together, these steps accelerate the entire AR cycle and strengthen suppliers’ financial position.

Streamlined AR Enables Operational Efficiency and Financial Agility

When AR is streamlined, suppliers also streamline their operations and set themselves up for success in any circumstances through:

- Fewer errors and disputes: Eliminating double entry means invoices inputs are accurate, and finance teams can stay lean and efficient.

- Faster approvals: Submitting invoices sooner helps suppliers get paid sooner.

- Cash on hand, always: Getting paid early ensures businesses can fund growth projects, cover payroll or navigate seasonal slowdowns without waiting on clients.

Ultimately, streamlining AR enables suppliers to maintain healthy working capital with low effort–no matter what.

Strong Cash Management Enables Suppliers to Confidently Navigate Uncertainty

From a strong cash position, suppliers can more easily:

- Pivot quickly to protect against risks when conditions shift.

- Take on larger projects or new opportunities as they arise.

- Build resilience for long-term success, regardless of volatility in the energy market.

Better Together: SupplierLink + FundThrough

Enverus SupplierLink and FundThrough invoice factoring work hand-in-hand to make this transformation possible:

- Enverus SupplierLink automates invoice submission by pulling invoices directly from suppliers’ accounting system, eliminating double entry.

- FundThrough Invoice Factoring enables instant invoice payments, turning long net terms into immediate cash.

| With Enverus SupplierLink, oilfield businesses like yours have: | With FundThrough Invoice Factoring, oilfield businesses like yours have: |

| ● Uploaded more than 100 invoices to OpenInvoice in minutes ● Saved 160 hours per month of staff time ● Avoided hiring additional resources to scale ● Reduced DSO by 50% | ● Gotten paid 52 days early on average ● Gotten an average of $195,000 per month in early payments for healthy working capital ● Reduced DSO to zero with instant payments |

By accelerating both halves of the AR cycle, these solutions empower suppliers to stay prepared in uncertain times—fueling growth, efficiency and long-term success.

Read the Case Study

2X Growth: How Bulletproof Electric Thrives in Uncertainty

Want to see this transformation in action? Read the case study to learn how Lisa Hawthorne of Bulletproof Electric doubled her company’s growth with the combined power of SupplierLink with FundThrough.