Enverus Intelligence® Research (EIR) estimates an average load growth of about 12 GW in PJM by 2035, driven primarily by data center load expansion. PJM’s independent market monitor filed a complaint arguing the grid operator has clear authority to delay interconnection of large new data centers until sufficient generation and transmission are available. The filing follows stalled stakeholder talks on new large-load rules and warns unchecked data center growth is inflating transmission costs and driving billions in higher capacity prices. The monitor is urging the Federal Energy Regulatory Commission to quickly clarify PJM’s authority as the board prepares its own interconnection proposal.

A recent EIR report analyzed 94 large-load tariffs from 36 utilities and determined large loads that bring their own generation can better flex demand during peak hours and benefit from rate structures tied to those highs. They can reduce demand during peak hours by participating in demand response programs or using an optimized battery storage strategy.

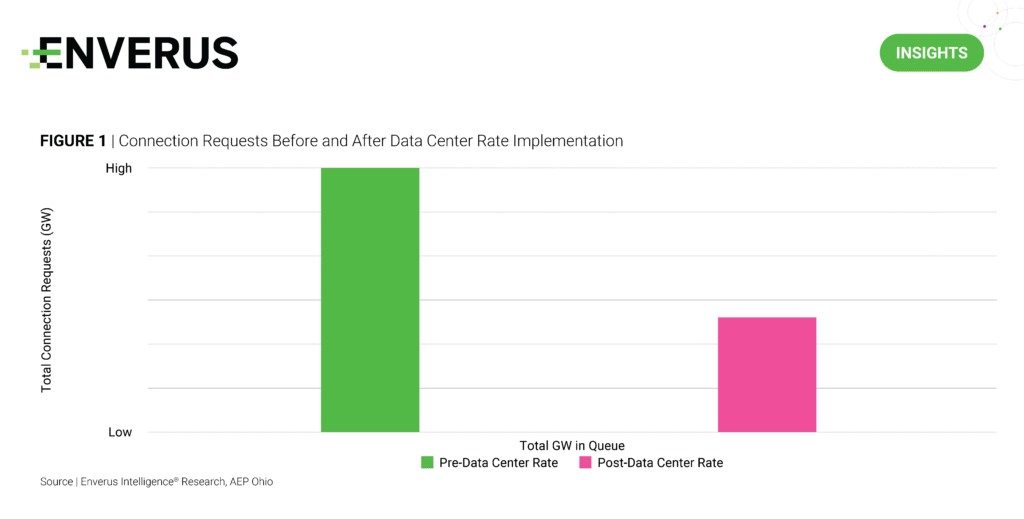

The experience in AEP Ohio, where speculative requests fell by more than half after a new rate was introduced, suggests tariff design itself can ease pressure on load-connection queues (Figure 1). Similarly, SPP’s High Impact Large Load process and Alberta’s proposed Bill 8 aim to prioritize or accelerate interconnection for those providing their own generation, demonstrating how policy and pricing signals can streamline the addition of major new loads.

Research Highlights:

- Distributed Generation | The Turbines Are Coming – This report challenges the general belief in the market that power-generating equipment, namely large turbines, is limiting near-term data center growth.

- Utility Rate Refocus | Reliable Cost Recovery – This report analyzes 94 electrical tariffs across leading cloud markets to better understand how utilities recover capital from large-scale customers and manage the surge in high-demand interconnection requests.

- Geothermal Acreage | Hot Rocks and High Bids – This report examines the tenfold rise in geothermal lease prices in the western U.S., driven increasingly by transmission access and data center proximity rather than subsurface traits.

DID YOU KNOW?

The Public Utility Regulatory Policies Act was enacted in 1978 to promote competition and energy efficiency by requiring utilities to buy power from qualifying facilities at rates based on the avoided cost of generating that power.

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. See additional disclosures here.