Unlike the energy industry’s pre-pandemic growth, today’s market is focused on lean operations, asset optimization and sourcing reserves as efficiently as possible. The current oil and gas development landscape presents many pitfalls and abundant opportunities, making it imperative to do more than merely “get ahead of the bit.”

Investors and operators need visibility into oilfield activity to optimize the many stages of pre-production — from permits through pad construction, drilling, completion and first production. However, public data lag gaps persist at every stage of well delivery, and when combined with widely varying operator behavior and timings, uncertainty accrues along with risk of missing opportunities.

Enverus’ Activity Analytics can help bridge the gap between permit and first production, unlocking solutions faster, no matter what you’re trying to solve in the energy sector.

- Minerals Owners: Understand where the market is moving for growth opportunities and keep a pulse on the current activity to accurately forecast revenue.

- Operator Asset Teams: Increase operational efficiency by coordinating service needs and rig logistics, track competitor activities by identifying potential frac hits before they happen and benchmark cycle times.

- Oilfield Services Providers: Assess current market needs and identify growth opportunities, benchmark competitors, and build market share.

- Financial Services Analysts: Stay ahead of operator movement with constantly updated well positions, rig locations and crew activity in any area to track operational and activity trends. Determine who is positioned for growth to uncover investment opportunities and track market shifts.

Watch our recent Activity Analytics webinar to learn how Enverus’ solutions can bridge the gap from permit to first production, no matter where you are within the energy ecosystem.

Permits to pad construction

Permits used to be the only way to know where and when new wells could potentially be drilled. While the number varies from basin to basin, only two of every three permits in the Lower 48 are drilled. If you rely on permits alone as an indicator of new production in or around your properties, you will be wrong 33% of the time, according to Enverus’ Activity Analytics. Operators often hedge their bets by permitting more sites than they know will be needed, change their development course or shift focus based on evolving economics.

How can we improve our odds? Leverage unprecedented detail through satellite imagery and radar analysis to identify true constructed pad locations.

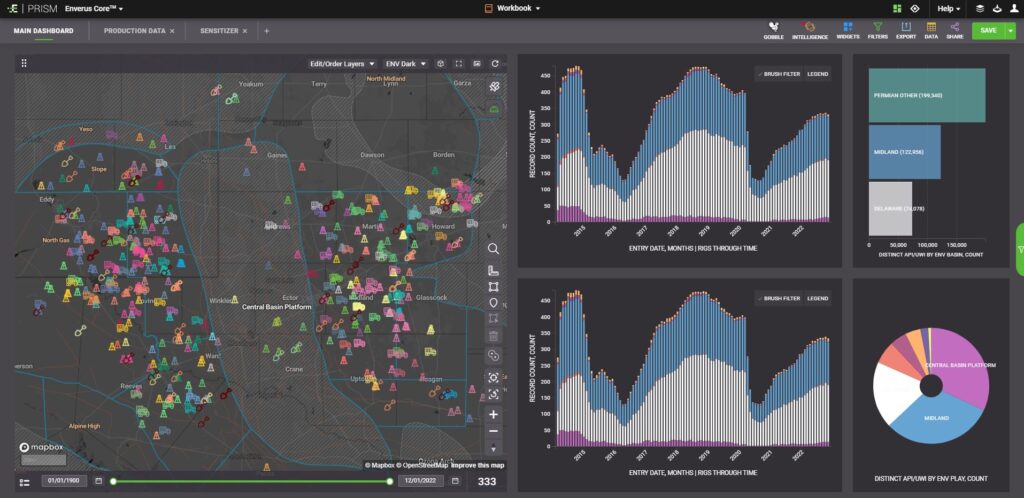

With Enverus’ PRISM, users can now filter for planned, but not yet permitted wells, run spacing analyses, assess subsurface risk, comb through operator activity and productivity, determine the economic viability of an asset and identify future inventory in one platform that your teams can leverage to get to their analysis faster. Anticipate new production in advance of the well permit being filed with the state, truly seeing ahead of the bit.

Active rigs and DUC inventory count

Use PRISM’s historical rig activity to benchmark different operator and service providers’ efficiency and drilling timelines. Pad construction to spud to rig release timing can vary widely depending on operator behavior and by service company. Enverus uses GPS tracking on more than 90% of Lower 48 onshore rigs to see all active rigs, as well as track historical rig activity.

Post-drilling, Enverus tags wells as drilled uncompleted (DUC) until a frac crew arrives on site. By monitoring how long DUCs sit, we gain a good understanding for frac fleet movement over time and the delay by operator.

It is critical to know if an operator is sticking to a typical development cycle or holding DUCs for inventory to be able to forecast future trends. In today’s market, this is where optimization comes into play, as burning DUC inventory depends on labor availability, pricing and economic trends.

Frac crew detection and completed wells

Until now, most teams could only track drilled wells, DUCs and completed wells, the latter well status being reported to the state and often out of date. Frac fleets are a limited and valuable resource. By knowing where the crews are, we can know with greater certainty when production is coming online. Activity Analytics uses machine learning algorithms to scour satellite imagery for the movement of the dozens of vehicles that herald the arrival of a frac fleet. We can know with certainty by correlating expected frac fleet movement with radar, which lights up the metal of the convoy’s trucks.

Frac crew detection is now available in the U.S.

Royalty and minerals investors can leverage these insights, and even call their operator’s owner relations center to ensure there’s no delay when the producer starts cutting checks on the new well.

Savvy operators can also use frac fleet movement detection to be proactive in their well neighborhood by shutting in wells to avoid frac hits and planning their development schedule efficiently.

Production

As a final step in understanding the time to first production, we also need to consider wells that have been completed but are not producing. This can happen for a variety of reasons, including wells that are waiting on services (WOS), such as gathering or production facilities that are yet completed, or wells that are flowing back frac fluids.

PRISM provides additional operator analytics to help you mine cycle times and get a good feel of activity between completion and first production, helping royalty and minerals investors know when they can expect additional revenue checks in the mail.

Right now, there is a widening capability chasm between the investors who only rely on permits and those who know with confidence where and when to expect first production because they leverage data and analytics across the well delivery process. Which side of the chasm do you want to be on?

Want to learn more about how Activity Analytics can help you optimize the many stages of pre-production? Fill out the form below to speak with an Enverus expert.