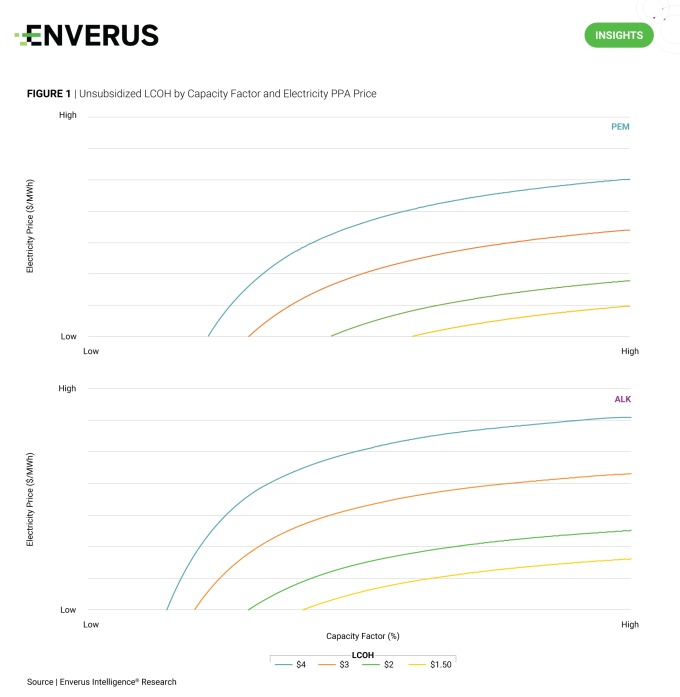

While we are still waiting for guidelines from the IRS regarding hydrogen incentives released with the Inflation Reduction Act (IRA) last year, it is clear that supportive policy must be in place for green hydrogen to compete in existing hydrogen markets. Enverus Intelligence Research’s (EIR) analysis suggests that unsubsidized green hydrogen projects must secure power purchase agreements (PPAs) below $10-$15/MWh and achieve capacity factors of at least 40%-60% to compete with gray hydrogen, which EIR estimate sells around $1.50/kg (Figure 1). However, meeting these conditions is extremely challenging, underscoring the need for tax incentives such as the 45V hydrogen production tax credit (PTC) to provide competitive returns for green hydrogen.

This point is further emphasized when considering that the average capacity factor for U.S. windfarms built since 2015 is 38%, which is insufficient considering that proton exchange membrane (PEM) and alkaline (ALK) hydrogen electrolyzer projects break even at 53% and 31% capacity factors at $40/MWh PPAs. Increasing the capacity factor from 55%-90%, which simulates an oversized windfarm and grid electricity paired with renewable energy certificates, respectively, raises the PEM NPV by a factor of 24 and the ALK NPV by around 2.5 times. Ensuring tax incentives like the 45V PTC allow projects to use grid electricity paired with renewable energy credits would provide flexibility for projects to meet carbon intensity requirements and support higher capacity factors, in EIR’s view.

Highlights from Energy Transition Research

- Energy transition – Expanding energy deal opportunities – This is the inaugural energy transition and power quarterly M&A review. It utilizes EIR’s energy transition M&A platform, which has captured more than 5,000 deals across 100 countries spanning power (generation, distribution, storage and integrated assets) plus alternative fuels, CCUS, equipment manufacturing, EVs and mining of energy transition metals.

- The ways to play – Energy transition opportunities for upstream participants – This report establishes a framework for how E&Ps can view and eventually participate in the energy transition. Upstream operators are increasingly exploring the energy transition, but many remain hesitant to deploy capital. Any decision, including inaction, must be well informed and deliberate in response to growing stakeholder demands. An operator’s energy transition strategy is strongly shaped by the context of its current business, the capabilities of its assets and workforce, and, most importantly, its conviction in the necessity to participate in the first place.

- EPA’s emissions revisions – More rules, double the methane, triple the tax – EIR quantifies the impact of the EPA’s proposed changes to Subpart W of the Greenhouse Gas Reporting Program, estimating the increase in total reported methane, overall CO2 emissions levels and IRA methane fee liabilities across U.S. sectors and basins. EIR analyzes the new emission source categories and modified calculations, focusing on the most material revisions and their potential to significantly alter the current emissions landscape in the U.S.

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. Click here to learn more.