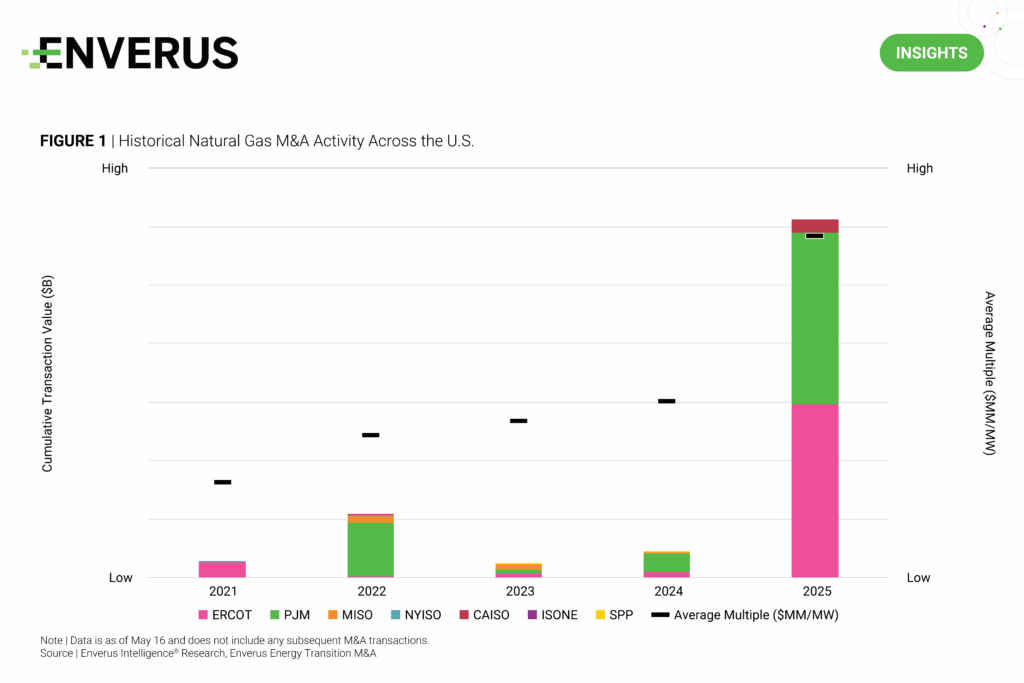

Natural gas power generation M&A has seen a sharp resurgence in 2025 (Figure 1), fueled by outsized load growth expectations, elevated power prices and rising barriers to new project development. Independent power producers and utilities are increasingly turning to M&A to cost-effectively secure operational capacity, particularly as supply chain constraints and inflationary pressures drive up the costs and timelines of new builds.

Recent transactions underscore this trend. The CEG-Calpine and CPX-LS Power deals both closed at ~$1.0 million per MW, while NRG-Rockland and NRG-LS Power traded at $0.8 million and $0.9 million per MW, respectively. The VST-Lotus deal, priced at $0.7 million per MW, reflects the lower end of recent deals yet still represents a premium over the $0.5 million per MW average observed between 2021 and 2024.

While 2025 multiples are well above historical norms, they remain materially below the $2–$3 million per MW estimates for the replacement cost of new gas generation cited in recent earnings calls.

DID YOU KNOW?

Combined-cycle natural gas power plants burn ~7.4 MMcf of gas for every GWh of power generated. They can reach thermal efficiencies of up to 60%, significantly higher than traditional simple-cycle gas turbines.

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. See additional disclosures here.