The Energy Transformation is a hot topic (pun intended), that much is settled.

Here at Enverus, we say “Energy Evolution” rather than “Energy Transformation.” Why? Transformation has a certain connotation that makes it sound like it can happen overnight or quickly. An Evolution takes place over a longer period and requires the right conditions to be in place.

There is no doubt about one thing when it comes to the Energy Evolution, it is happening one way or another. In fact, it never stops, it is a fluid and ongoing change that is navigated by every decision we make. These decisions can be as subtle as the smart thermostats that are becoming common in households, as in your face as the bipartisan infrastructure package (and what is, and is not, in it), and everything in between. Keeping this in mind, Enverus wanted to simplify these types of decisions into broad categories that can best be defined as “forces.”

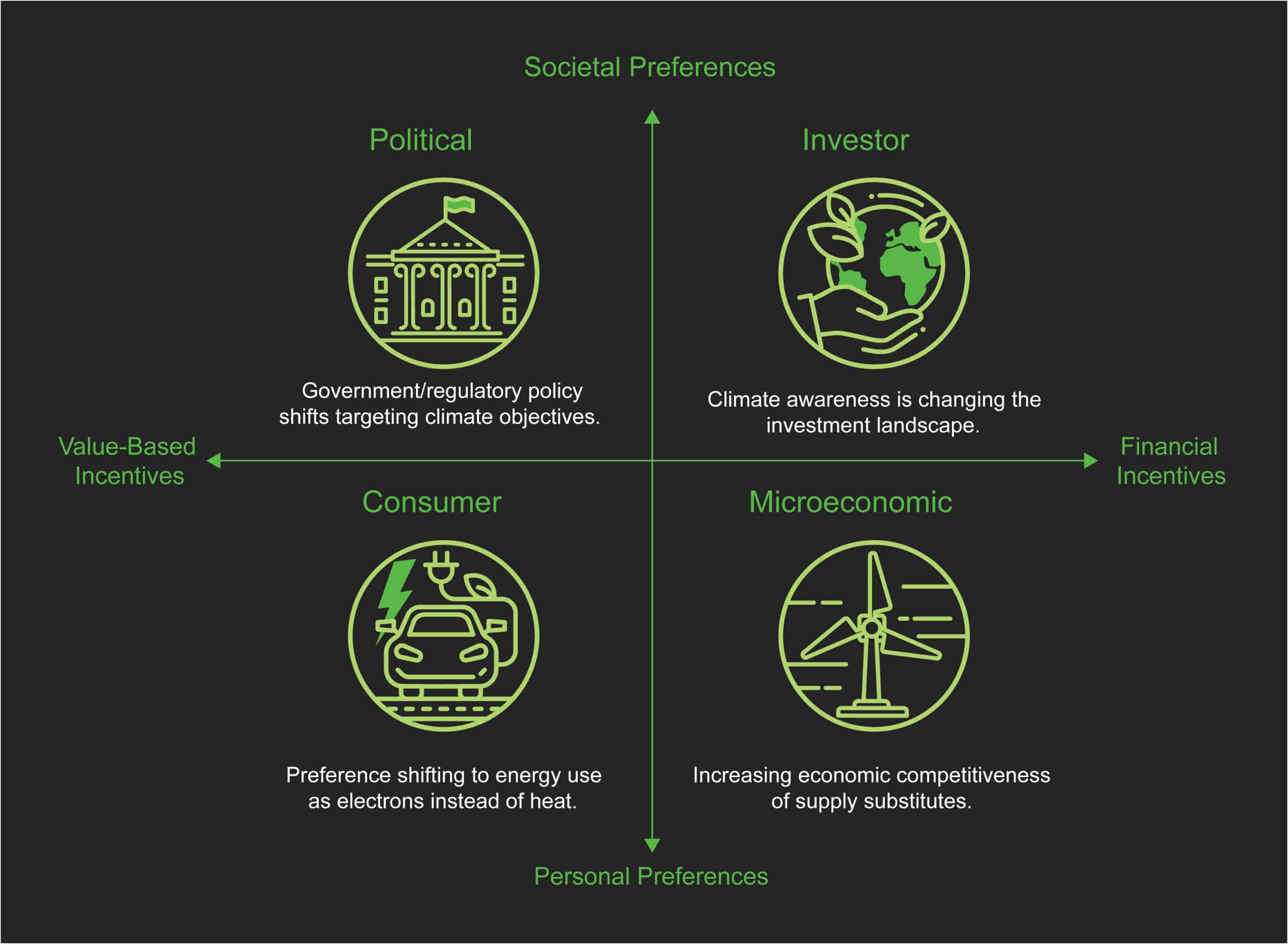

The four forces changing the energy landscape of advanced economies can be distilled into: political, consumer-driven, investor-driven and microeconomic (Figure 1). To the right of the origin, the incentives are financial. To the left of the origin, they are driven by personal and societal values. Below the origin, the preferences are those made by individuals (which can be a single person or entity). Above the origin, the preferences are societal. Although there are many things that may bleed over from quadrant to quadrant, Enverus finds that this framework is helpful when understanding the forces that are driving the Energy Evolution.

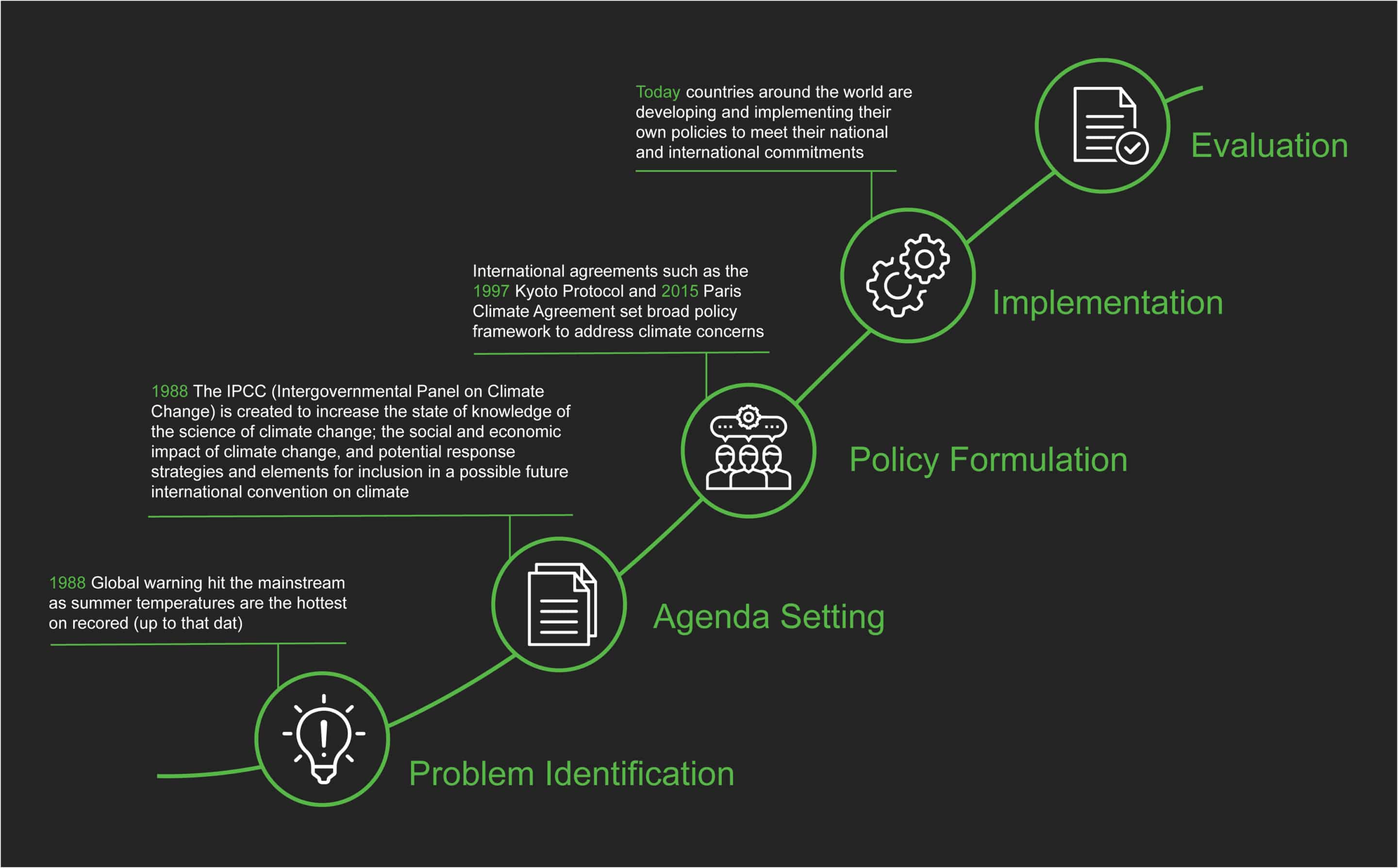

Let’s focus on quadrants II and III (left of the vertical axis for those who have long forgotten their two-dimensional Cartesian systems). Societal preferences are driving political and policy changes targeting climate objectives. The COP26 brought with it a whole host of new pledges towards meeting the climate change objectives of the Paris Agreement. It is key now to track how well these pledges are being implemented and evaluate their effectiveness towards meeting climate change goals (Figure 2). Consumer preferences are at the forefront of the ongoing electrification. More and more, the preference for energy use is shifting to electrons instead of heat. Where these electrons are coming from and the pace of the changes in the generation mix are key to quantify the impact of these preferences.

Now, we can shift our focus to quadrants I and IV (right of the vertical axis). Government incentives and regulations along with technological advances and cost declines are directing investment to clean energies from private investors with trillions of assets under management. Many of these investors have voluntarily announced initiatives or signed pledges to implement investment frameworks that take into consideration climate change. These investors engage closely with companies that make up a large portion of emissions, forcing them to reevaluate their energy sources and practices. It is paramount to understand the competitiveness of different generation sources and how the investment community makes its decisions when providing access to capital for a space that is brimming with projects, most of which will never make it past the proposed stage.

Although these preferences and incentives are driving clean energy evolutions in advanced economies, they are not without their shortcomings. The wants of the advanced economies do not always translate well or equitably to addressing the needs of developing and emerging economies. The Energy Evolution will create geopolitical tensions in resource-rich nations that are set to suffer from the implications of lower hydrocarbon revenue on their economies. Meanwhile, the new and emerging clean energy industry will create additional ripple effects in the global geopolitical landscape and drive new trade patterns.

The Energy Evolution will bring about a volatile energy landscape. It requires public and private investment, global collaboration and government intervention, at levels never seen before to realize the ambitious path to net zero. The Energy Evolution will not always serve the interests of those who are struggling to ease geopolitical tensions, consider issues of equitability, or even further human rights. It may not even be successful in achieving its goals of keeping surface temperature rise below the levels set forth by the Paris Agreement. However, the forces are strong and driving investment to the power and renewables sector at an ever-increasing pace.

Keeping the above four forces of the Energy Evolution for advanced economies in mind, this blog series will tackle the complexities of each via Enverus’ Power & Renewables platform. Additionally, we will discuss the implications of the four forces and the path that it leads us along for the Energy Evolution with expert analysis from the Enverus Power & Renewables team. Stay tuned to see exactly how Enverus can help you navigate the waves of the always fluid Energy Evolution.

Access additional articles here to continue reading about the Four Forces of The Energy Evolution.