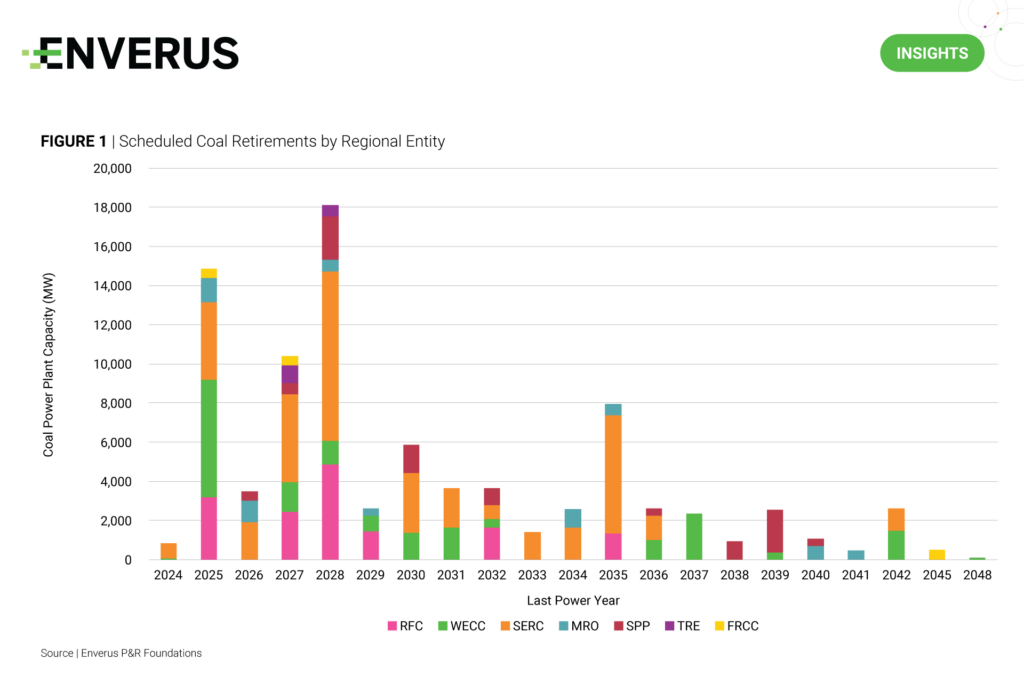

On March 25, 2024, the EPA released its final rulemaking on the update to 40 CFR Part 60 implementing its New Source Performance Standards for New, Modified and Reconstructed Fossil Fuel-Fired Electricity Generating Units. This rule introduces new requirements that will have major effects on existing coal power plants and any new, modified or reconstructed natural gas power plant. For existing coal power plants, there are three different categories:

- Facilities retiring before 2032, no emission standards apply.

- Facilities retiring before 2039 require retrofitting to accommodate 40% gas co-firing by 2030.

- Facilities retiring after 2039 require CCS installation to capture 90% of CO2 by 2032.

New, modified or reconstructed natural gas power plants will be required to be constructed with CCS technology capable of capturing 90% of CO2 from the plant. This rule dates back and applies to plants that began construction or reconstruction after May 23, 2023. While majority of coal power plant capacity is scheduled to come offline before 2032, we believe that this rulemaking will force existing coal plants to consider early retirement, which, coupled with the increase in complexity and cost of constructing new natural gas power plants, further exacerbates grid stability and may lead to high electricity prices in affected regions. There will also be a material impact on gas demand as coal facilities retiring between 2032 and 2039 potentially rush to retrofit facilities to co-fire natural gas by 2030.

Highlights From Energy Transition Research

Cummins | Big Engines for Bigger Data – We take a dive into the growth prospects for Cummins’ data center-adjacent business lines, which we believe is supportive for the equity.

Data Center Demand | Load Impact Imminent – This publication offers a Lower 48-level view on expected growth in data center capacity and associated power demand.

Tracking the ET Market | Improving Multiples in a Lower Cost of CapitalEnvironment – The 4Q23 edition of the Energy Transition Research team’s equity tracking report provides coverage across various energy transition sectors as well as integrated traditional energy businesses.