As the world debated the complexities of achieving net zero at last year’s COP28, regulatory pressures continued to increase in the U.S as the EPA announced its final Quad O rules aimed at sharply reducing methane emissions. Combined with the proposed updates to Subpart W of the Greenhouse Gas Reporting Program and the IRA’s methane fee or Waste Emissions Charge, we believe the next five years will prove critical for operators to adjust to the requirements of these separate but interconnected rulemakings.

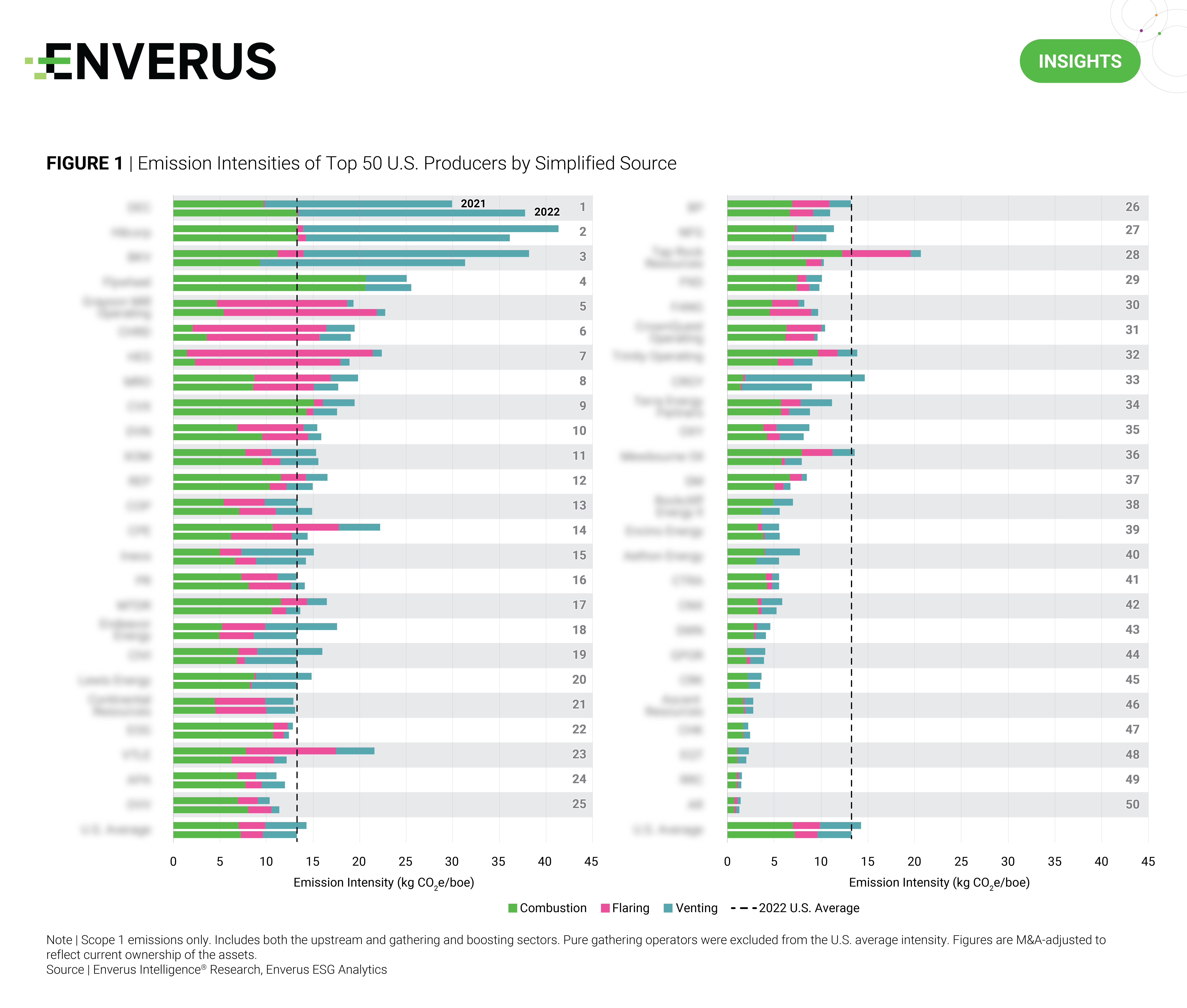

In light of these regulations, our U.S. emissions stocktake evaluates progress in the upstream and gathering sectors based on the latest EPA-reported data, analyzing trends from 2020 to 2022. We rank the top-producing operators by emission intensity in 2022, highlighting where operator efforts are paying off and which sources are harder to abate (Figure 1).

Of the top 50 U.S. operators in 2022 by production volumes, over two-thirds reported Y/Y decreases in cross-sector emission intensity; however, 18 companies still sit above the broader U.S. average of 13.3 kg CO2e/boe. The report dives into 20 of the most- and least-improved names on an intensity basis.

Research Highlights

Prism Signal | Alberta’s Renewed Path for Renewables

This report is designed to visualize the impact of Alberta’s renewable power policy update. It leverages shapefiles of Alberta’s land and overlaps them with Enverus Intelligence Research’s Power and Renewables data sets to identify at-risk projects that are affected by this new policy.

LCFS Price Forecast | Fool’s Gold Rush

A deep dive into the volatile California Low Carbon Fuel Standard credit market, including our forward pricing forecast and the impact it will have on capital investment and equities in the low carbon fuels sector.

U.S. Gas-Fired Generation | Fanning the Flame

Enverus Intelligence Research presents an updated view on the future of U.S. natural gas-fired generation after an outlier step change in 2023.