Explosive growth in artificial intelligence and the increasing prevalence of cryptocurrency mining are sending data center expansion through the roof. This surge, in combination with renewable energy volatility, is driving the need for effective resource management in data center construction and siting. Developers must quickly evaluate potential sites to stay competitive in the race for high-quality locations. Key pillars in site selection include energy availability, site quality and energy cost, with metrics such as available withdraw capacity (AWC), available acreage and access to transmission and fiber optic networks being crucial.

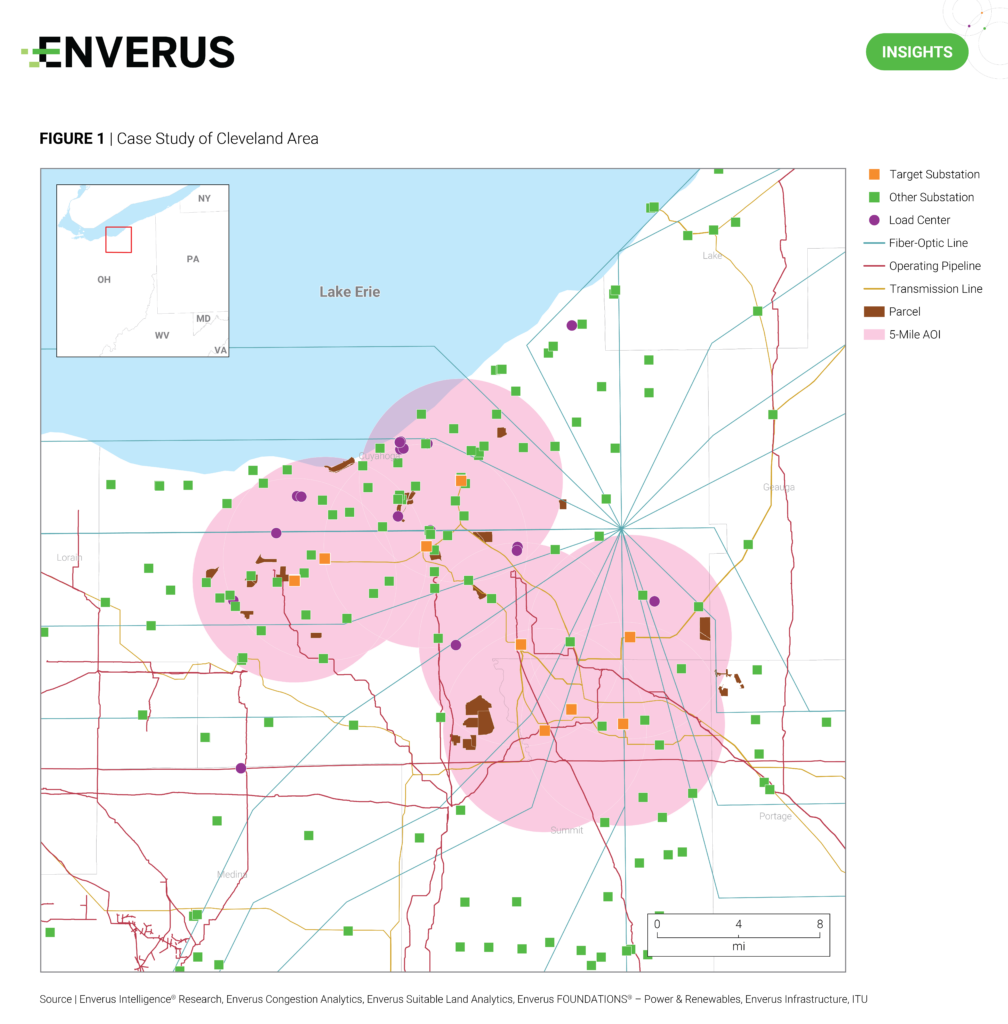

Enverus Intelligence® Research (EIR) has developed a workflow using Enverus PRISM® – Power & Renewables suite data and analytics to streamline data center siting. A case study examining the Cleveland area for 1,000 MW and 600 MW data center developments identified fewer than 20 high-value sites, meaning 99.998% were disqualified. EIR identified the Glenwillow and Hummel substations as ideal for 1,000 MW projects due to their large AWC, while the Inland and Hummel substations were best for 600 MW projects. The analysis demonstrated that while adequate AWC is essential for successful site selection, other factors contribute to site quality and can lead to better performance than high AWC sites.

Highlights

- Nuclear in Its AI Era – Enabling the Next Generation of Reactors – Demand for computing power coupled with the surge of AI is prompting technology giants to pursue reliable, low-carbon power sources for data centers, fueling a resurgence in interest in nuclear power. EIR evaluates various IPP’s existing nuclear energy portfolios and their opportunities for large-scale deployments.

- U.S. Power Grid – A Layered Landscape of Opportunities – This dynamic and interactive map provides a comprehensive view of the power asset landscape, including operating and developing projects across a variety of technologies, under-utilized plant capacity, and energy community tax credits, highlighting the most influential drivers of the U.S. energy transition. Designed to demonstrate the risks and opportunities within this evolving landscape, this map enables users to interact with data in innovative ways, unlocking critical insights.

- Alternative Fuels M&A – From Policy Boosts to Business Resilience – Deal flow in the alternative fuels sector has surged over the past four years, driven by regulatory incentives and the maturation of technologies that lower investment risk. We take a deep dive into notable deals across five fuel types to determine the most dominant strategies driving M&A activity and speculate on the implications for future capital deployment in the sector.

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.