The U.S. Senate proposed amendments to the One, Big, Beautiful Bill, increasing the 45Q tax credit for CO2 enhanced oil recovery (EOR) from $60 to $85/tonne, matching the rate for permanent sequestration. From an economic standpoint, this shift could have a meaningful impact.

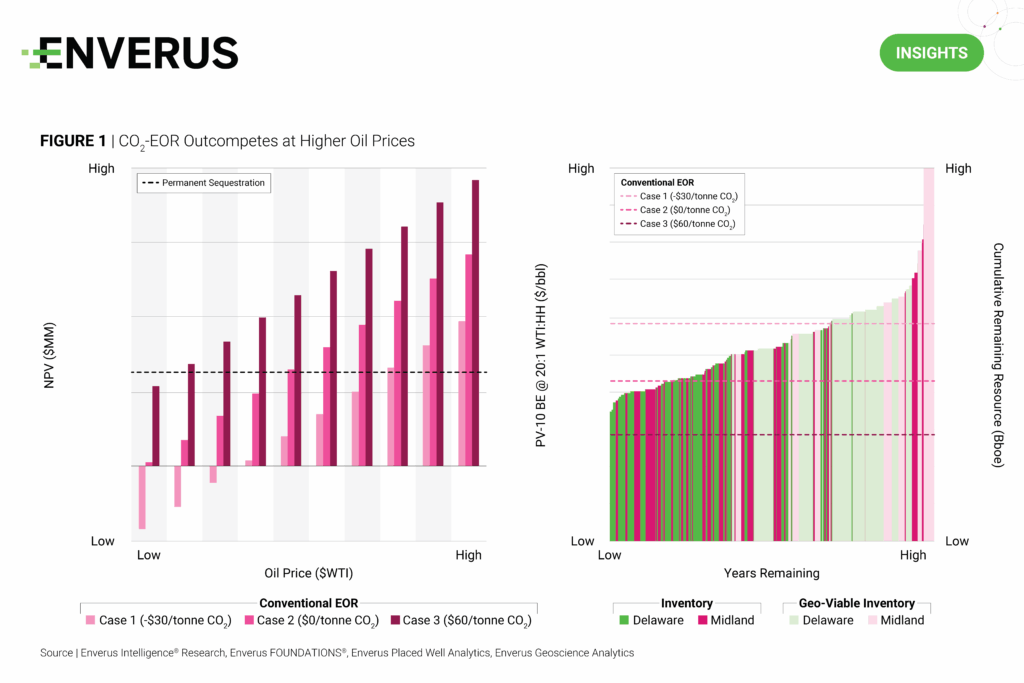

Based on our research, even under the previous tax structure, EOR was already commercially viable both in terms of production breakeven and when compared to permanent sequestration (Figure 1). Raising the tax credit to $85/tonne lowers production breakeven prices and renders EOR viable across a greater range of oil price scenarios.

At the original $60/tonne, we observe breakeven viability across remaining inventory in the Delaware and Midland basins. An $85/tonne credit only strengthens that outlook. Operators with existing CO2 infrastructure, such as XOM (Green Line) and OXY (Permian EOR operations) stand to gain from the change and are further incentivized to source anthropogenic CO2 for EOR operations.

The bill also proposes raising the 45Q credit for direct air capture (DAC) used for CO2 EOR from $130 to $180/tonne. OXY, through subsidiary 1PointFive, is developing the large-scale Stratos DAC facility in the Permian, which has the optionality to send captured CO2 into the Central Basin Pipeline for EOR operations. The higher credit would strengthen project economics and potentially reduce reliance on carbon removal contracts.

DID YOU KNOW?

A mature tree absorbs more than 48 pounds (0.022 tonnes) of CO₂ from the atmostphere annually. Trees also absorb pollutants like nitrogen dioxide, sulfur dioxide and ozone.

Research highlights:

- Infrastructure Alchemy – Coal to Low-Carbon Repowers – We analyze coal plants across the Lower 48 to determine optimal characteristics for repowering via natural gas, nuclear energy or enhanced geothermal generation.

- EVOLVE 2025 – Unlocking Value in Clean Fuels: Strategies for a Resilient Future – The clean fuels industry is at a critical juncture. An influx of low-carbon fuels has put downward pressure on U.S. credit prices, reshaping the economic landscape of the sector. This Enverus EVOLVE 2025 presentation explores how stakeholders can navigate these dynamics and develop more resilient business models to create sustainable value in the face of changing market conditions.

- Ethanol With CCS – Harvest Season for Carbon Credits – This report explores the remaining 24.7 mtpa opportunity for ethanol with carbon capture and storage, revealing which facilities and credit strategies are best positioned to unlock near-term value.

About Enverus Intelligence® | Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. See additional disclosures here.