Utility-scale solar and storage developer Pine Gate Renewables filed for bankruptcy last week, underscoring the growing pressure on renewable developers. The announcement follows months of speculation around the financial health of independent developers navigating a rapidly changing policy landscape.

Developers have faced mounting challenges this year after the One Big Beautiful Bill Act (OBBBA) slashed project economics across the wind and solar sectors. The rollback of key tax credits has sent project levelized costs of energy (LCOEs) soaring, in some cases doubling. This undermines returns and jeopardizes financing pipelines, separating resilient portfolios from those dependent on federal incentives to maintain profitability.

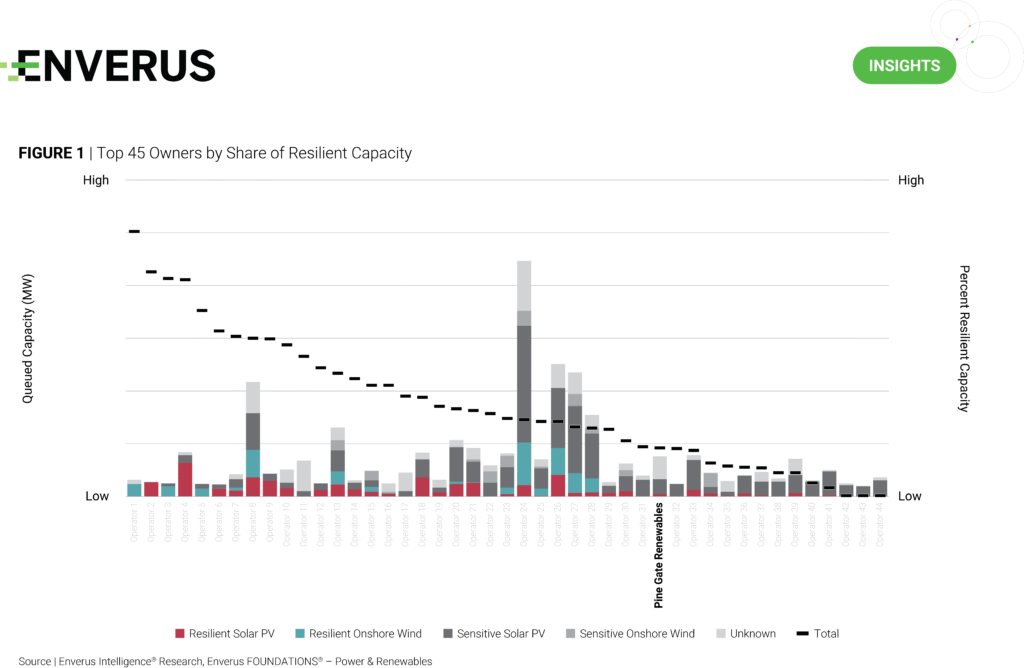

Enverus Intelligence® Research’s portfolio resiliency analysis ranks developers based on the share of capacity with merchant power and renewable energy credit (REC) revenues exceeding before-tax LCOEs, excluding the impact of tax credits. Projects in markets with generation-weighted price premiums demonstrate greater insulation from the phaseout of Inflation Reduction Act (IRA) incentives. Against this benchmark, Pine Gate Renewables falls on the lower end of the resiliency spectrum, with just 18% of total capacity remaining economical without tax credit support.

While some projects remain eligible under the safe harbor provision — requiring construction to begin within 12 months of the OBBBA’s passage — prolonged interconnection timelines lower the likelihood of success. Pine Gate Renewables illustrates the pressure felt among mid-tier renewable developers as the market resets around a leaner, post-incentive reality.

Research Highlights:

- ERCOT BESS Update | After the Gold Rush – We examine the ERCOT BESS market, focusing on once-lucrative ancillary strategies in a now-saturated market and strategies of top operators.

- The Cost of Carbon Innovation | RNG, CCS and Hydrogen Operator Economics – Examines the returns profile of various clean fuel pathways including blue and green hydrogen, and the impact of IRA tax credits to economics.

- Class VI Update 3Q25 | Ethanol Plus CCS Surges, Approvals Trickle In – We examine the recent changes and additions to the growing list of Class VI wells associated with CCUS projects in the U.S.

Enverus Intelligence® | Research, Inc. is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts, and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. See additional disclosures here.