The power trading landscape is rapidly evolving with the significant growth of renewable energy sources such as wind and solar. For traders in the Financial Transmission Rights (FTR) markets, understanding these trends is crucial for effective strategizing. In this blog, we discuss the detailed dynamics of wind and solar generation, focusing on key insights and data projections from the MISO, ERCOT and SPP regions, derived from our Mid-Term Nodal Renewable Forecast tool.

Wind Generation Trends

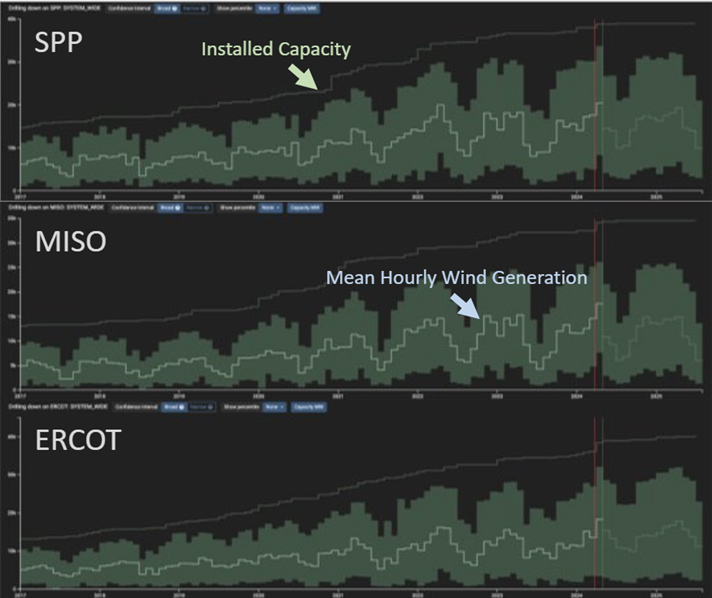

Exponential Growth in Wind Capacity

Since 2017, wind capacity in key independent system operators (ISOs) has witnessed exponential growth. For instance, ERCOT’s installed wind capacity has surged from 13.2 GW in January 2017 to an anticipated 38.3 GW by April 2024. Similarly, SPP has increased from 14.7 GW to 38.8 GW, and MISO from 13 GW to 34.1 GW within the same period. This substantial increase underscores the growing contribution from wind energy, highlighting its expanding role in the power generation mix and its implications for market dynamics and volatility.

Detailed Hourly Wind Generation Projections

The Mid-Term Nodal Renewable Forecast tool provides granular projections of mean hourly wind generation during on-peak hours, derived from our Enverus Research team’s data. This includes projections of the 5th and 95th percentiles of wind production, offering traders critical insights for anticipating various production scenarios. For example, the 95th percentile projections during on-peak hours provide a robust metric for high production scenarios, essential for effective risk management and strategic planning in the FTR markets.

Solar Generation Trends

Remarkable Surge in Solar Capacity

Solar energy is following a similar growth trajectory. In MISO, installed solar capacity has increased from 1.3 GW in January 2018 to 10.8 GW by April 2024, and is further projected to increased to 15.9 GW by July 2025. ERCOT and SPP also show significant upward trends, with ERCOT expected to grow from 1.4 GW to 30.7 GW, and SPP from 382 MW to 1.2 GW within the same timeframe. This rapid increase in solar capacity underscores the expanding influence of solar power on the grid and its impact on grid volatility.

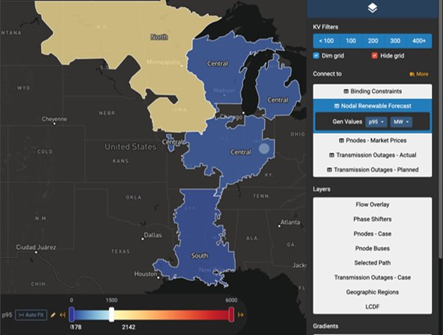

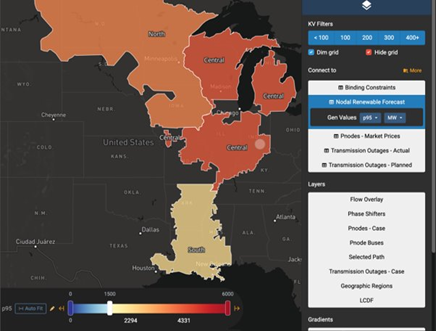

Regional Solar Generation Insights

(Source: Mid-Term Nodal Renewable Forecast in Panorama)

Our regional analysis reveals stark contrasts in solar generation between 2020 and 2025. For example, in June 2020, regions like South and Central MISO produced less than 1500 MW during on-peak hours, as indicated by blue on the maps. By 2025, these regions are projected to generate significantly more, with Central and North MISO turning red on the maps, indicating higher solar generation. This shift highlights the substantial increase in installed capacity and its impact on the grid’s behavior and stability.

Weather and Renewable Fleet Dynamics

Importance of Weather Dependence

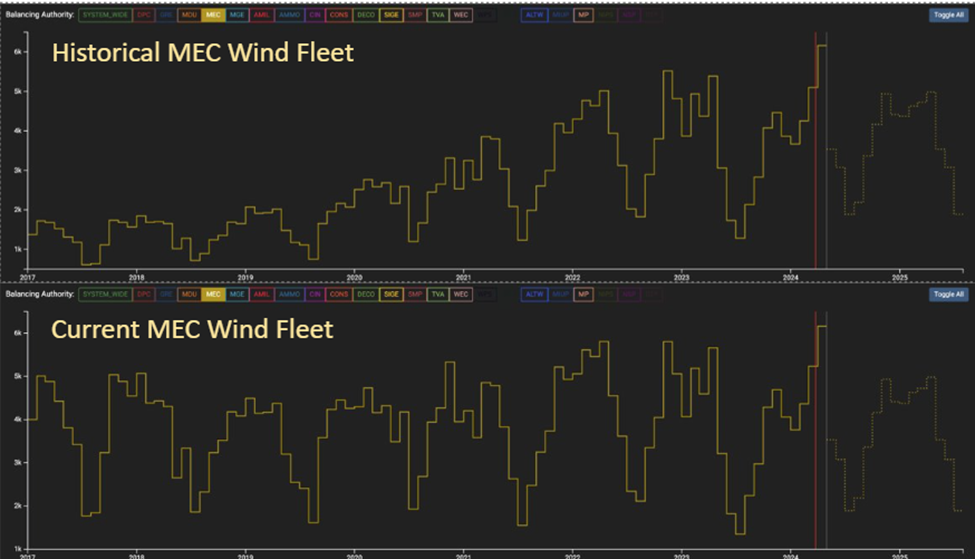

Renewable energy sources such as wind and solar are highly weather-dependent, introducing intermittency and unpredictability. FTR traders must understand weather patterns to manage these challenges effectively. The Mid-Term NRF tool models both historical and current fleets to separate the effects of weather from fleet growth. For instance, despite increased capacity, low wind months like June 2023 can result in reduced generation, emphasizing the importance of weather-informed trading strategies.

Navigating an Evolving Grid

An evolving grid with increasing wind and solar farms introduces new complexities for traders. Understanding the growth of installed capacities and their regional variations helps traders anticipate market behaviors and volatility. For example, analyzing wind production trends from 2017 to the 2025 forecast for the MISO MEC Balancing Authority, we see that installed capacity has grown from 2.9 GW in January 2017 to 8.5 GW by April 2024. Modeling wind production using today’s fleet enables traders to understand the annual variability due to weather, aiding in better decision-making.

Harnessing Insights for Future Trading

The rapid growth of wind and solar capacities across major ISOs is reshaping the power trading landscape, creating new volatility patterns and opportunities. For mid-term power traders and FTR traders, leveraging tools like the Mid-Term Nodal Renewable Forecast is crucial for mitigating risks and capitalizing on these changes. By understanding and anticipating renewable generation trends, traders can navigate the evolving grid with enhanced confidence and strategic foresight, ensuring they stay ahead in the dynamic energy market.