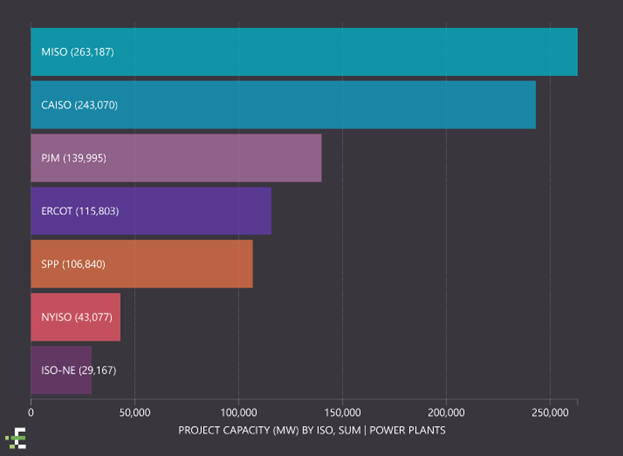

Renewables are a necessity to counter growing power demand and support decarbonization, but however, finding the least costly and most viable location for renewable assets is becoming increasingly challenging. In Midcontinent Independent System Operator (MISO), more than 240,000 MW of proposed solar and wind projects have been withdrawn within the past five years, the most for all independent system operators (ISO) in the United States (Figure 1). Developers in MISO are faced with high upgrade costs resulting from congestion in the grid, an inability to find locations where the solar and wind resources can support their projects, and a struggle to find suitable land for projects. By evaluating planned transmission lines along with solar and wind yields and buildable acres, developers can overcome many of these challenges and find prime renewable project sites at lower upgrade costs and achieve higher returns that are not obvious at first glance.

Evaluate planned transmission to find sites with lower upgrade costs

To counter the challenge of grid upgrade costs within MISO, developers can consider sites near planned transmission lines as feasible points of interconnection when siting projects. These planned or under construction transmission lines will likely soon have the available capacity to support interconnection, helping relieve the potential upgrade costs associated with connecting to the grid.

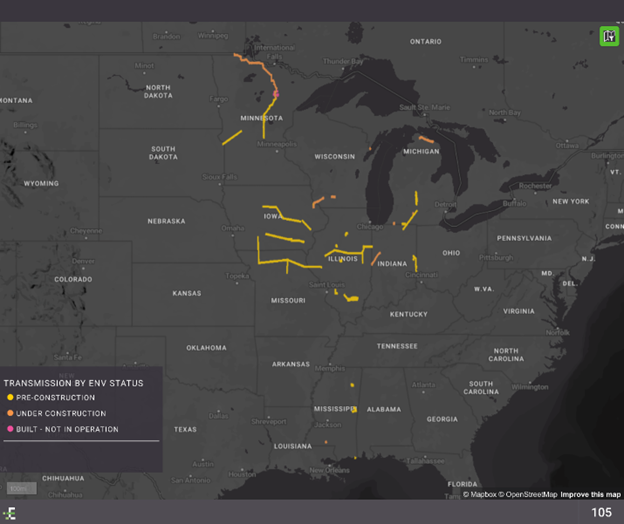

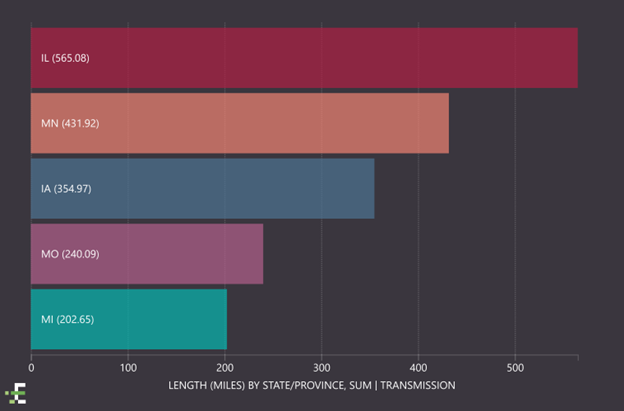

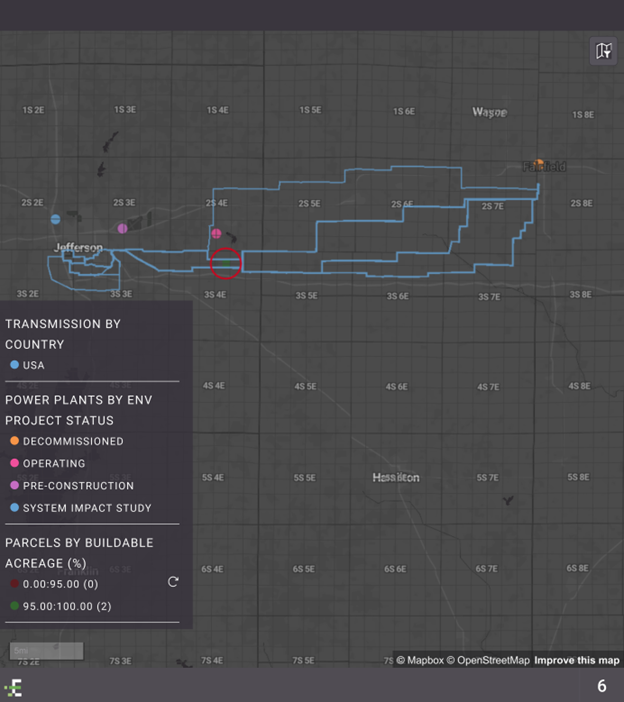

This map from Enverus PRISM® (Figure 2) displays where planned transmission lines are located within the MISO region. Planned lines are any lines that have the status of “Pre-Construction”, “Under Construction” or “Built – Not in Operation”. The bulk of the new builds in MISO are in Illinois (Figures 2 and 3).

It is pertinent to note that proposed transmission lines will often contain multiple potential routes that are being considered in the planning process. Thus, projects in the “Pre-Construction” phase will typically include some route possibilities that never come to fruition. By the time construction starts these routes will be narrowed down to just the chosen locations.

Finding the highest solar and wind yields to maximize returns

Based on the prevalence of planned lines within the state, Illinois could be a promising location for project development. However, the presence of new-build transmission lines is not enough to ensure that a solar or wind asset will succeed. Beyond the transmission infrastructure present, developers must also consider the prevalence of solar or wind resources that would ensure the highest yield for their plant.

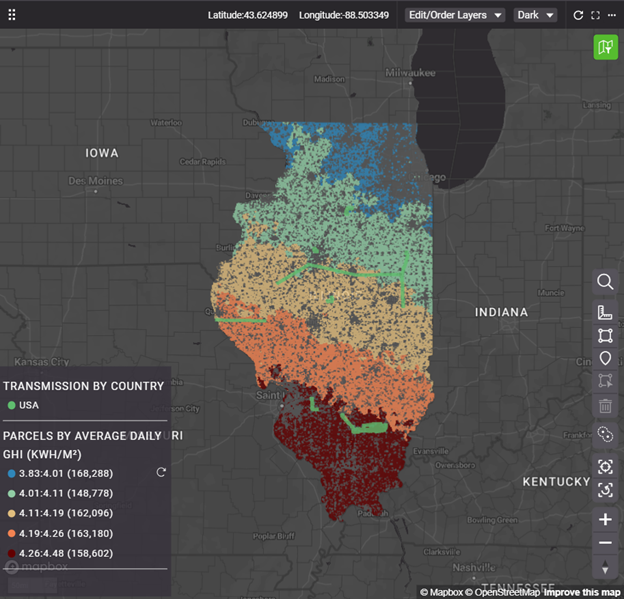

For solar assets, global horizontal irradiance (GHI) is a valuable measure of the total solar radiation on a horizontal surface. It is used to estimate expected PV panel output. Figure 5 shows a map of Illinois with both the average daily solar GHI and all planned transmission lines overlaid on top. It is optimal to site solar projects in areas with higher GHI values.

A solar developer would likely focus on the southern portion of Illinois, where average daily GHI values are generally higher than the remainder of the state, in turn resulting in more effective solar plants.

The Mt Vernon Area Reliability Project (ENV Transmission ID 146487) is the largest planned line within this region of Southern Illinois, where daily GHI values are consistently higher. It is currently in pre-construction and is owned by Ameren Illinois, one of the largest transmission owners in the MISO. It stretches across both Jefferson and Wayne counties, Illinois – two of the top five counties in the state by planned transmission line miles. And when complete, it will consist of two segments: a Mt. Vernon-Reifen substation route (projected to be complete by the end of 2025) and a Reifen-Kays substation route (projected to be complete by the end of 2026). Each of these segments currently has seven possible proposed routes, but eventually only one route from each segment will be built.

Finding sites with buildable acres

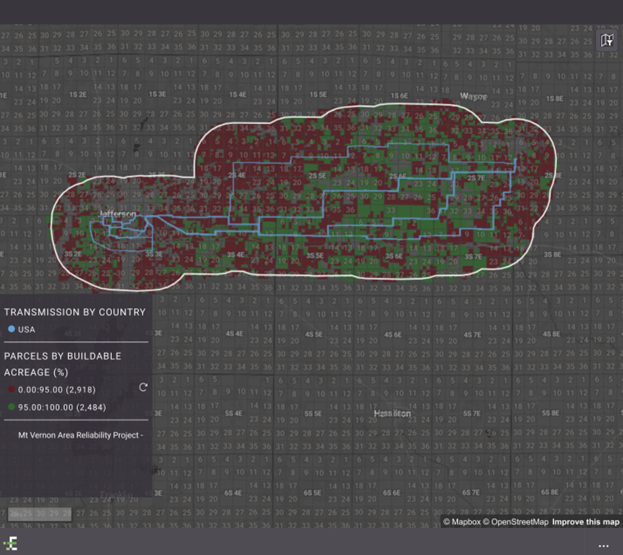

After identifying potential areas with favorable solar and wind yield and a high likelihood planned transmission lines will be built nearby, developers can start to narrow down their search to the parcel level and find sites that would be suitable to build their next renewable project. Figure 6 shows a map of all parcels within three miles of at least one of the possible transmission line routes, sorted by their percentage of buildable acreage. Parcels color-coded green have over 95% buildable acreage, while red parcels have less than 95% buildable acreage.

Developers can leverage these parcels surrounding the Mt. Vernon Area Reliability Project (Figure 6) as ideal sites that have the potential for successful solar assets. However, this introduces the next challenge for a developer looking to site solar in MISO. How does one narrow down their search to land that is viable to build on?

The ability to assess buildability at scale is critical. In Figure 6, all parcels within three miles of at least one of the possible transmission line routes have been color-coded by the percentage of buildable acreage available. Green parcels have a buildable acreage percentage over 95%, meaning that less than 5% of its land area contains excessive slope, canopy, floodplains or wetlands. This feature can be utilized to highlight the parcels that are most viable for building solar plants.

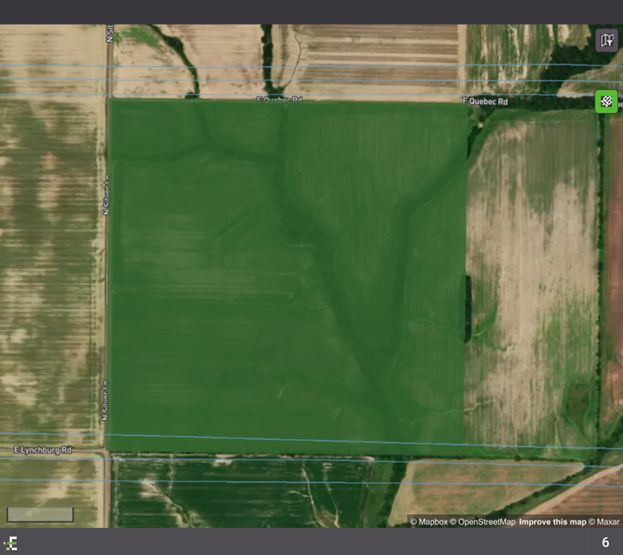

Two parcels that fit this criterion particularly well are highlighted in Figures 7 and 8.

When dealing with transmission projects that still have multiple route options available, it is important to keep in mind that only one route per segment will ultimately be chosen. For this reason, users will want to look for parcels that are located nearby as many of the route options as possible. In doing so, they are prepared with potential project sites near whichever route is eventually chosen.

These parcels fit that requirement well- they are directly adjacent to seven of the eight possible routes for the Reifen-Kays segment of the project (Routes I-N), so there is a high likelihood that they will be in prime position for easy interconnection access to those lines. Both parcels also have a buildable acreage percentage well over 95%, so there is lots of room to build a project.

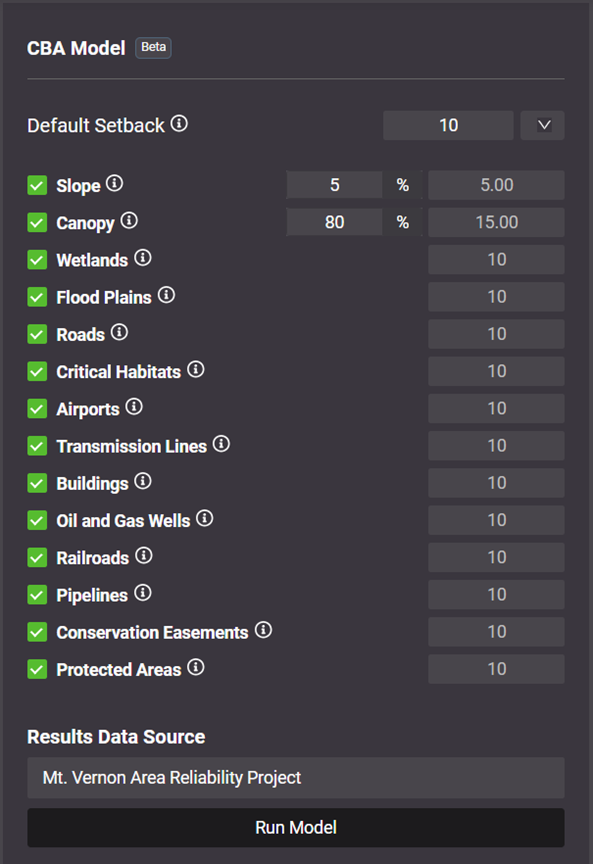

Once a developer finds land that is buildable, they then need to assess where within that plot of land they could site their project, as well as potential hinderances to development. Each developer has different criteria for land they consider buildable. In PRISM, the Customizable Buildable Acreage model includes the ability to manipulate these settings to conform to a developer’s specific needs (see Figure 9 ).

Figure 10 shows a map of those parcels with the customizable buildable acreage tool applied and the settings as shown in Figure 9. This feature allows developers to get a far more detailed understanding of the parcel’s actual layout. While the buildable acreage % can be useful for quickly ruling out parcels that would be difficult to build on, siting a project requires getting a sense of where exactly the hazards are to understand how the land can be used to complete a project.

In Figure 10, we see the result of applying the CBA model settings from Figure 9 . The default setback selected in this example is 10 feet, meaning any hazards on the map also extend out 10 feet in all directions, except slope and canopy whose setbacks were slightly different. Building directly next to heavy canopy, roads or wetlands, for example, will often not be feasible, so the model includes setbacks to show where panels could be placed on the parcel. However, this is highly customizable. If a developer were in a situation where they were required to leave 20 feet between panels and roads, for example, they could easily make that change.

Also, the Slope and Canopy settings allow users to customize the severity of those hazards they want to account for. In this example, slopes greater than 5% and canopy densities greater than 80% were set as cutoffs. Developers who are willing to build on more extreme slopes though, for example, or who only want to deal with very sparse tree canopies, can easily make those changes within the tool.

This allows developers to get a much more detailed view of where exactly on the parcel they can and cannot build, and the exact obstacles in the way. In these parcels (Figure 10), for example, the western half of the lot appears clear to build on, but the eastern half contains some wetlands, canopy and high-slope areas that will need to be worked around.

Leveraging the planned transmission line dataset allows developers to site projects in places where available transfer capacity will be high and grid upgrade costs will be low. In conjunction with tools like the solar GHI feature, the parcels buildable acreage %, and the Customizable Buildable Acreage Model, developers can quickly evaluate large swaths of parcels to find suitable sites for renewable projects. With the use of these PRISM tools and datasets, users can discover prime sites that others may have overlooked if they had not performed an in-depth analysis on the planned transmission lines, solar and wind yields, and buildable acres.