California used to be a golden state for solar power producers, but recent changes in the market pose challenges for a technology expected to be a critical part of the state’s drive to meet its emissions targets. Depending on timing of generation and prevailing system demand, capture price — the average electricity price a renewable project receives for its power — can be higher or lower than the average daily power price. Solar generates power during the day when there is typically more demand, which often means producers can sell to the grid at a premium. Or at least this used to be the case.

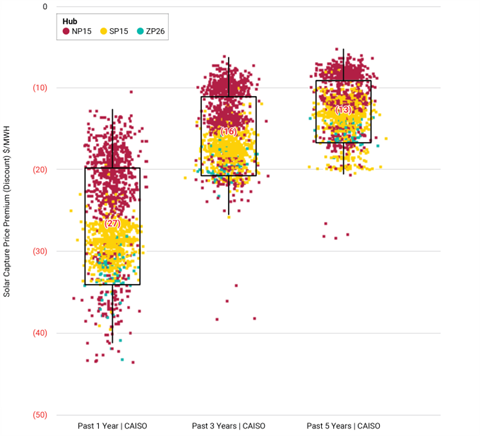

FIGURE 1 | CAISO average solar capture price discount over time.

Figure 1 shows the erosion of the solar capture price in the California ISO (CAISO) over the past one, three and five years. With solar now accounting for over a quarter of in-state generation, net system load has been drastically reduced from 8 a.m. to 6 p.m. when solar is producing. As a result of this increased solar penetration, solar projects in CAISO now receive a capture price discount which average has widened from -$13/MWh to -$27/MWh over the past five years.

While this is bad news for uncontracted stand-alone solar projects, it could be a boon for projects with co-located battery storage. These assets could charge with discounted power during the day, then discharge in the evening and take advantage of shifted peak pricing. Economics aside, these flexible resources will be critical in maintaining system reliability as renewable penetration increases to meet state-mandated goals.

Highlights from Energy Transition Research

1. Enverus PRISM® Signal: CAISO solar challenge — Exponential growth degrades prices

Solar capture price — the average electricity price a project receives when generating electricity — is being impacted by exponential renewables growth. This PRISM Signal examines how the capture price in CAISO has been cannibalized by state-mandated clean energy targets.

2. Exxon pledges $17B for decarbonization

Energy Transition Pulse is published every two weeks by Enverus and covers the renewable energy sector, carbon management and ESG investments, including projects, the deal market, finance and new technologies.

3. CCUS — Capturing the costs

How much does it cost to capture CO2? Where are the most economic opportunities across the U.S. and Canada?

Introducing the Treasure Chest

As part of our commitment to innovation, we are thrilled to announce the addition of a new report series for our Energy Transition Research clients called the Treasure Chest. This series gives clients exclusive access to Energy Transition data sets that have not yet migrated into our SaaS solutions but can be incorporated into PRISM with Enverus Intelligence Research’s proprietary Fusion Connect technology.

Recognizing the paramount importance of providing our clients with the most innovative and current information, we are committed to constantly enriching our dataset offerings and sharing an updated list on a quarterly basis.

The first release of the Treasure Chest comes with:

- CO2 storage maps for the Gulf Coast and Appalachia that are necessary for evaluating CCUS opportunities.

- U.S. orphan well locations useful for evaluating P&A opportunities, or CO2 storage risk.

- Water chemistry data including lithium brine concentrations and brine total dissolved solids for assessing lithium opportunities or enhancing petrophysics with improved water resistivity calculations.

- United States heat demand helps identify thermal opportunities for heat-pumps or cogeneration.

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence Research, Inc. is a subsidiary of Enverus and publishes energy-sector research that focuses on the oil and natural gas industries and broader energy topics including publicly traded and privately held oil, gas, midstream and other energy industry companies, basin studies (including characteristics, activity, infrastructure, etc.), commodity pricing forecasts, global macroeconomics and geopolitical matters. Click here to learn more.