Operators and oilfield service companies need to keep pace with the volatile and rapidly evolving energy industry. However, if you are relying solely on public filings to make investment decisions or anticipate future activity, you’re shortchanging yourself. Public data often lags by three months and can be inaccurately reported. If you consider the state of the industry three months ago compared to today, you know the public filings are not going to get your company to where it needs to be in the next quarter.

Every day there is a new headline to consider, with direct implications to near-term strategic planning. Whether the global news involves the economic downturn affecting oil demand, such as Russian supply being hit with EU sanctions or the major economic headwinds in China, or LNG construction delays, these geopolitical events affect daily market trends and drive changes in oilfield activity.

In our October 2022 “Macro Forecaster” published by Enverus Intelligence Research, our analysts assert that weakening economic conditions and outperforming Russian supply will incentivize crude and product builds. Embedded in this view was extensive analysis on North American supply, specifically in the Lower 48. We detected well pads being constructed in real time, outlined historical and current trends in rig deployments and frac crew demand, and offered productivity metrics in a single platform, so you can stay ahead of the changing energy landscape.

Using Activity Analytics, we uncovered three key trends to help you know what’s happening in the oilfield.

1. DUC inventory is nearly depleted

In the published report, analysts suggest excess drilled uncompleted (DUC) inventory is nearly depleted, with new wells coming mainly from newly drilled inventory. This shift in strategy comes from oil price pressures easing while operating costs rise.

Using only publicly filed permits, your ability to assess the change in strategy would be both delayed and incorrect, because not all approved permits will see drilling activity. Focusing your efforts on satellite detected constructed pads, you will have an accurate, near real-time view of where drilling, completions and production will occur, rather than taking an educated guess on which permits will be drilled.

With detected constructed well pads, you can determine:

- Where and when service companies can be poised to support operations.

- If pricing environments are worthwhile for operators to continue development plans.

- If the DUC duration from a specific operator falls within a normal timeframe compared to peers, or if it seems the operator is sitting on the asset.

2. Pricing power for service providers as demand outpaces supply growth

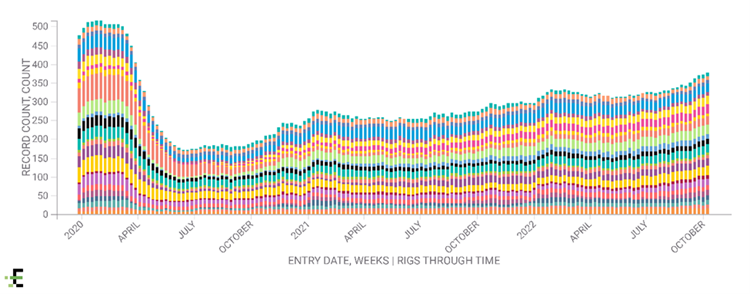

For operators and service companies alike, it is crucial to keep tabs on demand for oilfield goods and services. Active rig tracking shows demand continues to outpace the ability and desire to grow supply, leading to increased pricing power for service companies.

Additionally, analysts expect the rig count in oil plays to increase further in 2H22, while rigs targeting gas are expected to decline in 2023 due to takeaway constraints.

Leverage real-time, GPS monitored rig activity to understand where more than 90% of the rigs are in North America to directly inform how you can fit your strategy to near-term market trends.

Use proprietary rig and drilling tracking to:

- Indicate subsequent investment from operators.

- Assess changes in market share from service companies.

- Determine which types of rigs can support your asset development plan to save service costs.

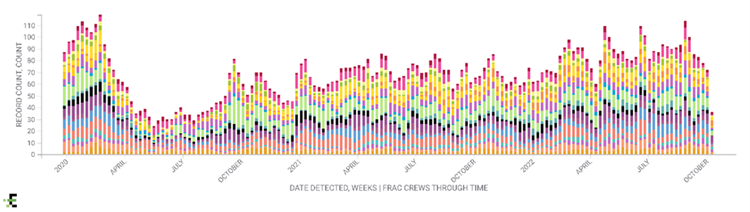

3. Frac crew demand pushes upper bounds of available capacity

Frac crew demand continues to push the upper bounds of available capacity, meaning equipment shortages are creating pressure on service companies to fulfill scheduled fleet activations.

Operators are making an early start in planning for 2023 to lock in materials and assets for the year. However, the U.S. is currently operating at a near 100% effective crew utilization, limiting overall production growth. Leveraging satellite informed completion activity allows for an accurate, near real-time view of frac crew activity and utilization.

Get ahead of delayed and inaccurate completion filings to:

- Identify where and when operators are completing wells, giving you an indication of when wells will complete their lifecycle.

- Understand fluctuations in activity and future market needs.

Enverus Activity Analytics offers insights into changes in activity levels across North America. With access to both active and historical pad construction, drilling and completions, you can:

- Find answers faster to determine who is positioned for growth to uncover investment opportunities and track market shifts.

- Increase efficiency by getting an edge on development planning and more accurate production timeline predictions.

- Save time and resources by having all data sets and intelligence linked in a single platform.

Learn more about how Activity Analytics can help you stay informed about important oilfield events.