Oil and gas operators are having a decent year so far, price-wise, with WTI lately hovering near $70/bbl. Who could imagine prices were nearly $100 lower in April 2020?

Despite the healthier margins for operators, the lessons learned from 2020’s dramatic decline in oil prices will not be forgotten. Oil and gas operators continue to be more vigilant with spending and cost management.

Rising oil prices translate to rising fuel costs

Depending on the size of the operator, fuel costs can add up to a $25 million to $150 million spend category. Fuel costs are rising this year in conjunction with stronger oil prices, so operators will continue to look for ways to ensure no overspending is overlooked.

The way that suppliers charge operators for fuel costs is improving. Five years ago, fuel costs were “all-inclusive” supplier day rates, giving operators little control or visibility into fuel-specific costs needed to manage drilling and completions.

Today, fuel costs are “split,” giving operators improved spending control. Despite this improvement, Enverus estimates that operators continue to overspend by 3% on fuel, mostly due to the inability to audit the specifics of fuel invoices.

Click below for access to a complimentary trial of MarketView with OPIS rack pricing data!

In order to recover the 3%, operators need to effectively:

- Automate fuel price entry.

- Validate transportation charges.

- Audit historical fuel and transportation charges.

Today, we’re going to dive into the first step: automating fuel prices based on OPIS rack rates.

Take advantage of Enverus’ long-lasting partnership with OPIS

OPIS, the Oil Price Information Service, is the go-to fuel rack price for U.S.-based fuel suppliers. Enverus has supplied its trusted rack prices to customers via the MarketView platform for 20 years. The visibility gained with using MarketView enables operators the transparency that they crave.

- Utilize the OPIS index for price discovery and that all-important look into the market for assurance that you are being invoiced properly.

- Looking at NYMEX only does not bring the full picture and doesn’t tell the complete story — you must look at rack pricing assessments from market experts.

- Verify your contracts in real-time using our MarketView ExcelTools add-in.

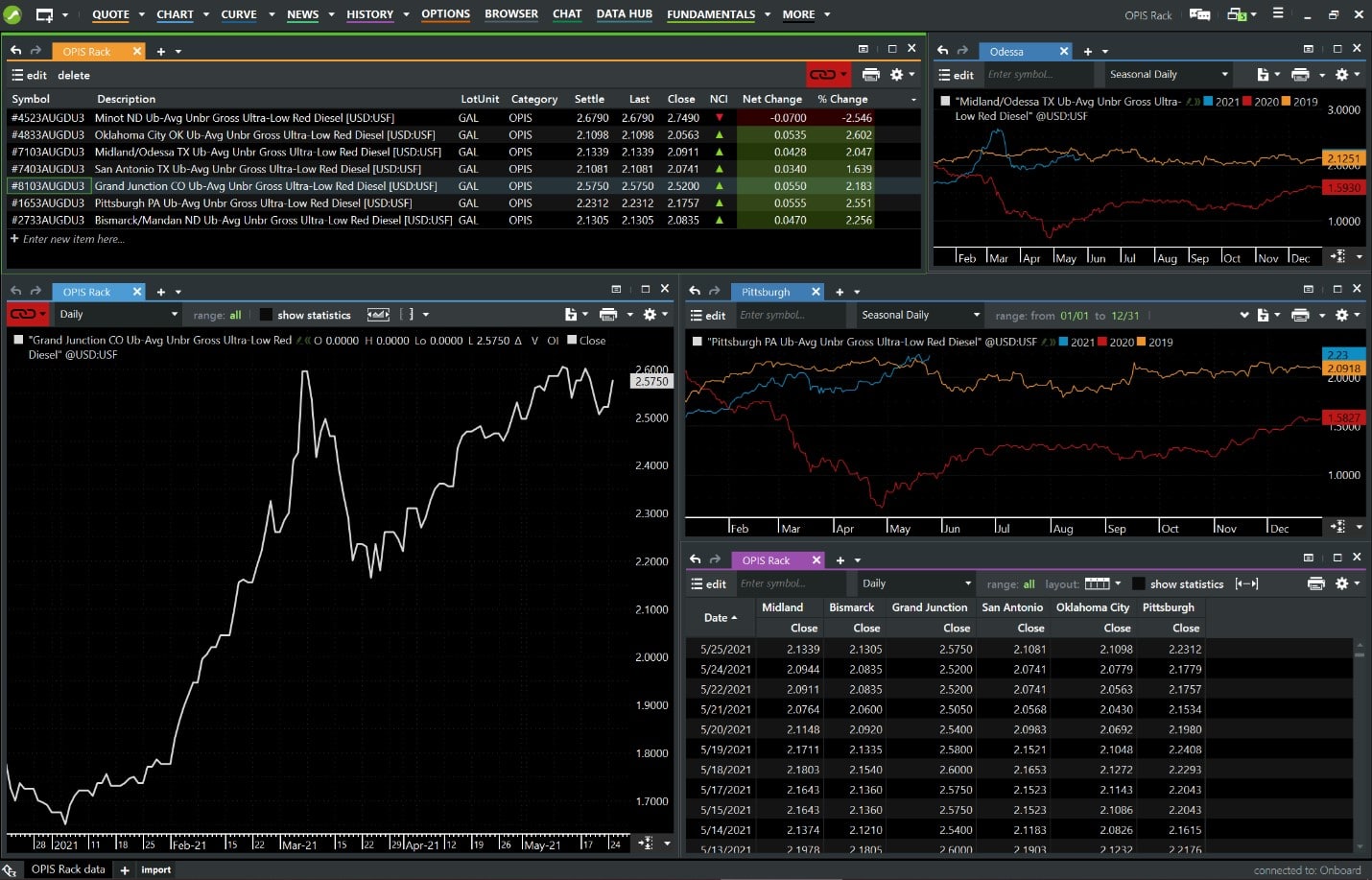

FIGURE 1 | Track the OPIS rack prices that matter most to you with MarketView Desktop.

With MarketView, finance and accounting professionals can receive OPIS rack pricing and other essential energy market indices in real-time. The platform also allows users to automatically feed OPIS pricing into their daily workflow. Even in Excel, users can automatically pull the day’s rack prices with confidence and ease. The lightweight software provides robust price data on the go — whether users are working from home or back in the office, accessing OPIS pricing is simplified with MarketView.

Receive complimentary access to OPIS rack price data

For the first time ever, our partners at OPIS are working together with us to offer a complimentary trial of OPIS data within the MarketView platform. We are excited to extend this offer to you! Please fill in the form here to express your interest and set up your trial.