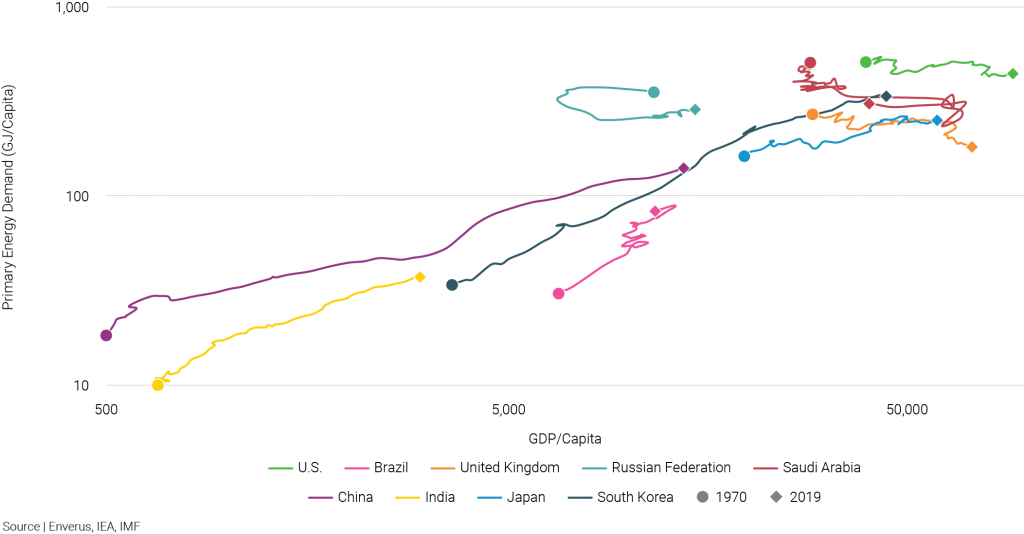

The U.S. leads the world for per capita consumption of primary energy harvested directly from natural resources (Figure 1). While oil, solar and hydro are examples of primary fuels, electricity isn’t. Rather, different types of primary energy are transformed into power that turns on lights at the flick of a switch. The maturing of the U.S. economy and the push to decarbonize because of climate change mean the mix of suppliers of primary energy in the future will be different from today’s.

We expect total U.S. consumption of oil, natural gas, coal, renewables and nuclear to decline ~10% over the next 20 years. Tighter CO2 emissions standards and increased penetration of electric vehicles will shave gasoline demand over the next decade by more than 1 million barrels of oil a day, according to our estimates. But it’s not all bad news for the petroleum industry as we expect natural gas will maintain its share of the U.S. fuel mix over this time frame.

President Joe Biden is preparing a $3 trillion infrastructure plan that will include large sums to modernize the country’s the electrical grid. We think the emphasis should be on building infrastructure to give regions with better renewable resources access to demand centers. Delays in building U.S. transmission infrastructure are already resulting in an uneconomic allocation of capital investment in renewables-fired generation. Regions with higher potential to displace coal-fired generation/carbon-heavy generation are being passed over in favor of those, such as California, where current renewables-based generation is being curtailed due to oversupply.

FIGURE 1 | Primary Energy Demand per Capita vs. GDP/Capita (Log Scale)