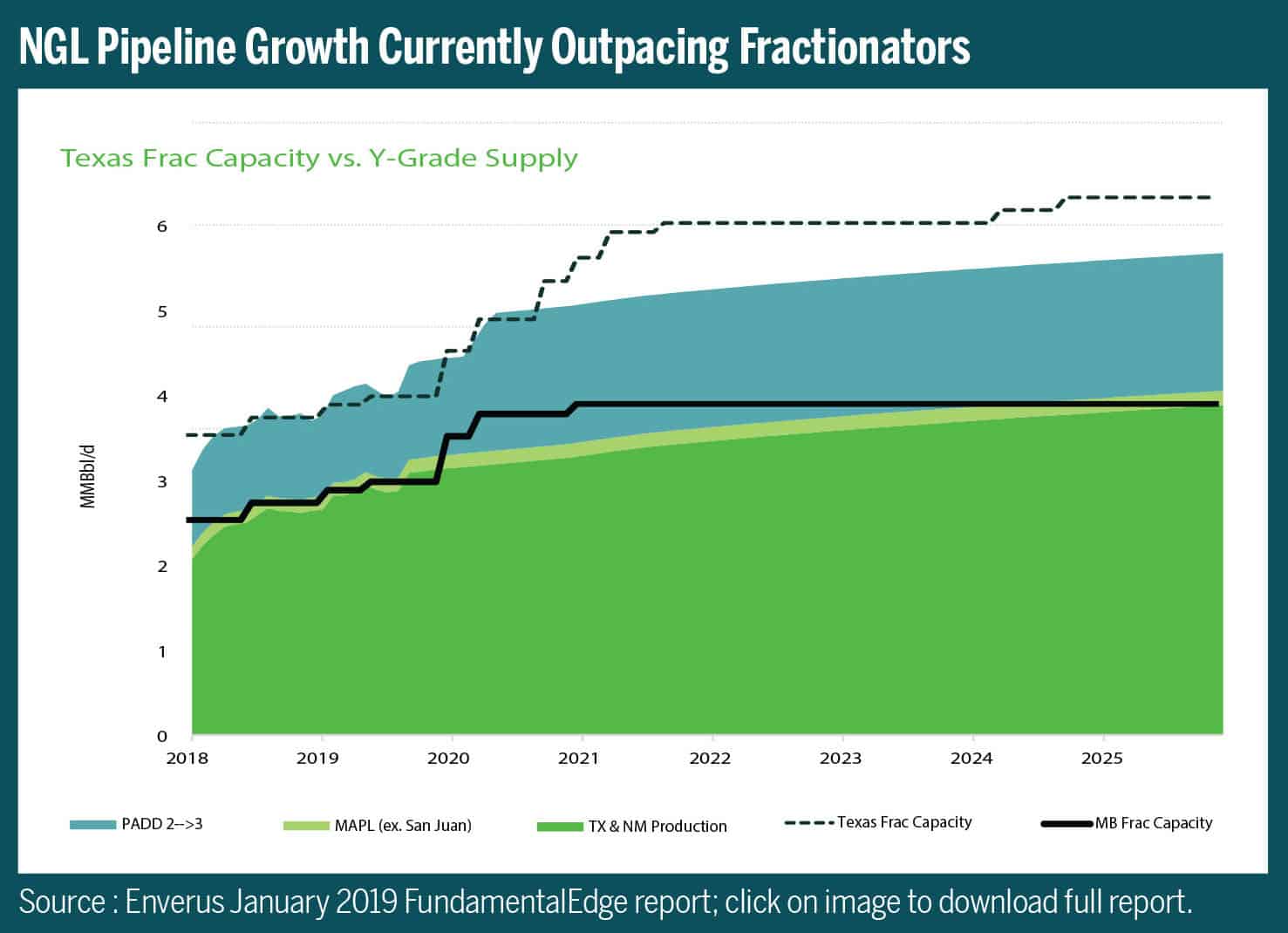

NGL pipeline construction to the Texas Gulf Coast has moved faster than fractionation projects, causing frac capacity to run short for much of 2018 and 2019, according to Enverus’ FundamentalEdge report for January. However, though more pipelines are coming this quarter, the extended capacity crunch will begin to lift. Oneok and Energy Transfer will put into service fractionators in Q1 at the NGL hub of Mont Belvieu, Texas, and other projects will come in later this year and early 2021.

Throughout most of 2018 and 2019, fractionation capacity ran tight in Texas. Two major Y-grade pipeline projects out of the Permian—Enterprise Products Partners’ 550,000 bbl/d Shin Oak and Targa Resources’ 300,000 bbl/d Grand Prix—came online in 2019 to feed more volumes to the Gulf Coast.

Two projects will add to this supply shortly. Oneok’s Arbuckle II pipeline, a $1.36 billion newbuild, should go into service in Q1. Arbuckle II runs from northern Oklahoma to the Mont Belvieu hub.

EPIC Midstream Holdings’ Y-Grade pipeline from the Delaware Basin to Corpus Christi, Texas, has carried oil since it was completed last summer, but once its dedicated crude pipeline is completed in late Q1, it will switch over to NGLs.

Fractionation capacity at the end of 2019 was about 3.4 MMbbl/d and capacity expansions, both at Mont Belvieu and other areas of Texas, will begin to hit the market in 2020 and beyond. In 2020, roughly 1.4 MMbbl/d of new capacity is expected, with about 600,000 bbl/d of those expansions coming to Mont Belvieu.

Enterprise chief commercial officer Brent Secrest said in October that his company’s fractionators were full at Mont Belvieu, although some capacity could be found in Louisiana and in the Midcontinent. The partnership started up its 10th fractionator at Mont Belvieu in 4Q19, and an 11th is to enter service in Q2. The incremental 300,000 bbl/d of the two fractionators will bring its capacity there to more than 1 MMbbl/d.

In addition to their fractionators scheduled for Q1, Oneok and ET intend to start fractionators in Mont Belvieu in 1H21. Both of Oneok’s fractionators will have a 125,000 bbl/d capacity with MB-4 starting in Q1 and MB-5 in 1Q21. ET will put into service two 150,000 bbl/d fractionators, with Frac VII in Q1 and Frac VIII in 2Q21, bringing its capacity there to nearly 1.1 MMbbl/d.

Targa Resources is in the midst of a 320,000 bbl/d fractionation expansion in Mont Belvieu. The first train started in 2019, and two more will enter service before Q4.

Outside of Mont Belvieu, Phillips 66 is building two 150,000 bbl/d fractionators at its Sweeny hub in Old Ocean, Texas. DCP Midstream holds an option to acquire a 30% stake in both when they are completed in Q4.

EPIC will complete a 100,000 bbl/d fractionator at its Robstown, Texas, facility near Corpus Christi, in Q1. The company reached a final investment decision in December for a second one slated for completion in 3Q21.

Between December 2019 and December 2025, Texas is expected to add 2.3 MMbbl/d of fractionation capacity, while Mont Belvieu will add 800,000 bbl/d. FundamentalEdge forecasts that this will lead to Texas frac capacity exceeding by roughly 1 MMbbl/d NGL supply from PADD 2 and 3—the Gulf Coast and the Midwest—starting in 2021.