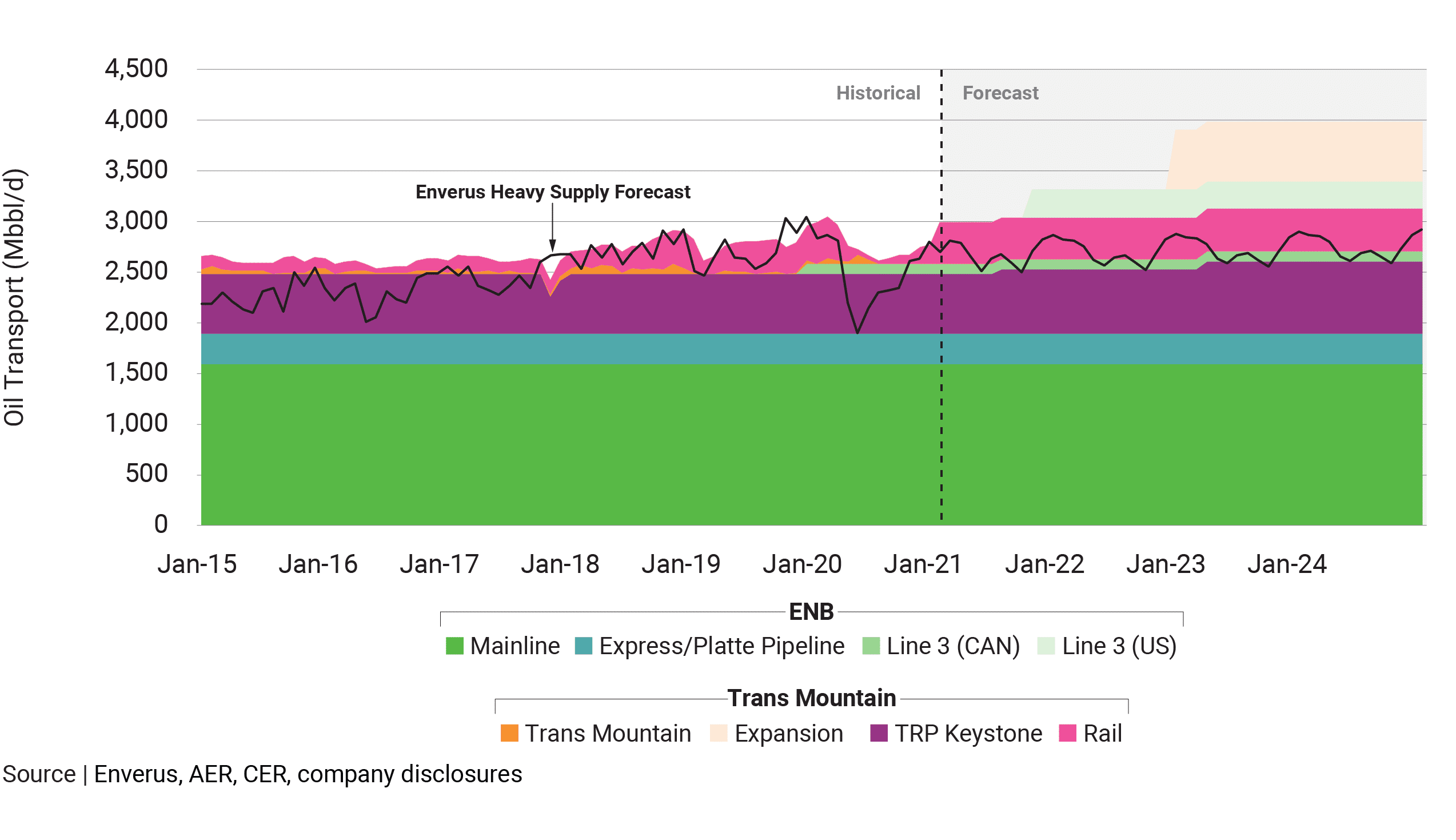

Despite reduced capital spending in the Canadian oil sands since 2015, production grew from 2.4 MMbbl/d in January 2015 to 3.6 MMbbl/d in December 2020 (Figure 1).

Our monthly oil sands forecast individually models 48 projects by assessing a company’s near-term guidance, development plan, turnaround schedule, blending patterns and activity data from Prism. The detailed analysis enables forecasts on inventory levels, prices for different types of crude (heavy oil sells less for than light) and demand for condensate, used to blend heavy oil in pipelines for better flow.

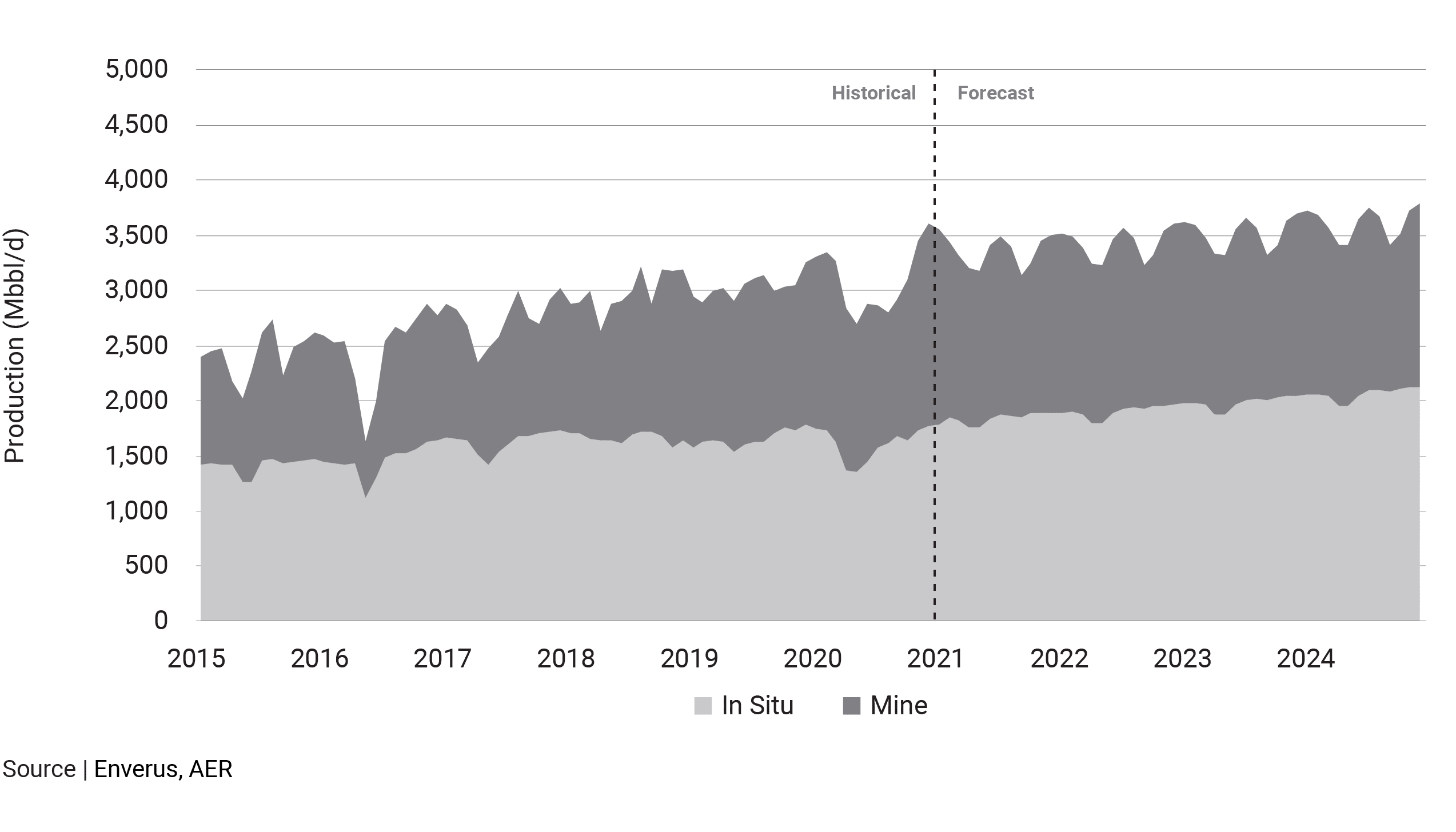

Until egress constraints become a thing of the past (Figure 2), oil sands production and pipeline capacity forecasting is critical with respect to the differential between Western Canada Select, a key marker for Canadian oil production, and West Texas Intermediate, the benchmark for U.S. futures. Armed with the right information, clients can anticipate price blowouts between the various grades of oil, such as the one in 2018 where the differential widened to -US$46/bbl.

Each month Enverus clients have access to an updated forecast allowing them to make decisions about operations and investments with this actionable insight.

FIGURE 1 | Oil Sands Base Production Forecast

FIGURE 2 | Heavy Oil Stack and Pipeline Takeaway Capacity