Working From Home For the Holidays – Tips for Risk Analysts

As most risk analysts know, it’s difficult to truly observe a local holiday at home when your company does international trade deals with countries all over the world. It’s scarcely any different for those of us who work in the business of distributing, collecting, or analyzing market data. The imports, exports, and pipeline flows you […]

Learn What It Means to Democratize Forward Curve Generation

Does your trade floor have a separation of powers? Our Enverus team members focused on trading and risk always attend the Energy Trading Risk Summit to soak in the thinking and logic of risk analysts. It’s inspiring and fascinating to see the lengths risk managers will go to protect data integrity and implement mitigation strategies. […]

Enverus Makes Sense of the Madness to Drive Trading Profits

Energy trading risk and market volatility derived from the U.S. presidential election are best managed with verified, accurate news and data management Enverus is delivering secure, validated and intelligent data solutions to commodity trading companies navigating the complex and dramatic impacts of geopolitics — and the current U.S. election — on energy commodity markets. Will […]

Chum Salmon Operations, La Nina Bullish for 2020 BPA Hydro

The Bonneville Power Administration (BPA) Columbia River System is most known for marketing the power in one of the world’s largest hydroelectric systems, but that’s not all. Since the passage of the 1980 Northwest Power Planning and Conservation Act, BPA is responsible for supporting fish and wildlife conservation programs. In early October water levels are […]

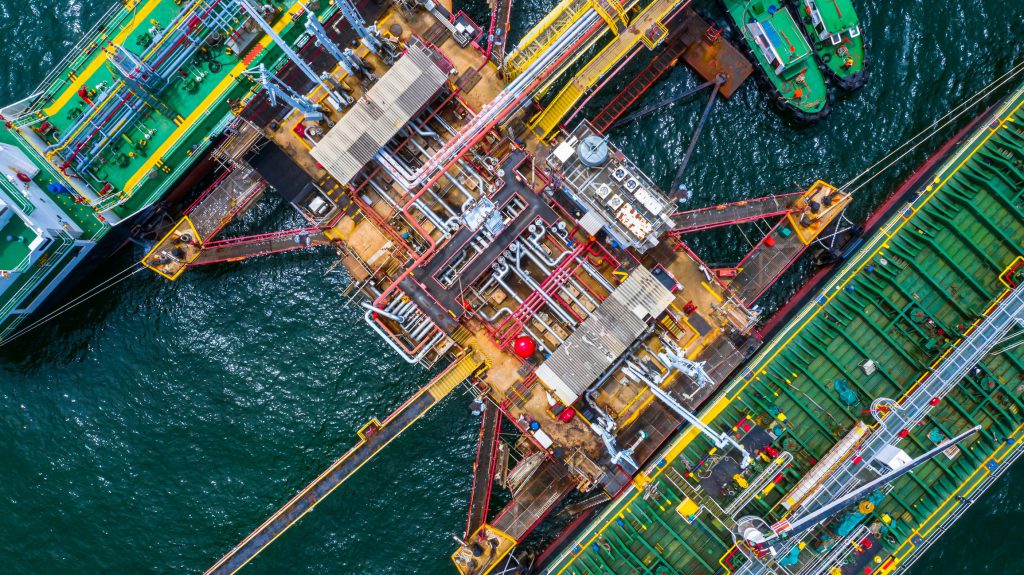

When Oil Prices Stabilize, Find New Arbitrages with Better Data

For the oil traders who feed off volatile price movement and market inefficiencies to make profits, the past few months have been a bit of a drag. After the first half of 2020, which was the most volatile period of many crude traders’ careers, the third quarter brought oil merchants a calm, range bound WTI […]

Battling Blackouts with Accurate Renewable Power Forecasting

As a professional power market forecaster, you better believe that I hate to see instances of rolling power blackouts. Americans from California to New York are experiencing power interruptions this summer, which brings on loads of new market risks to individual consumers and businesses alike. Thankfully, the latest scare in California was manageable for utilities […]

Delivering Oil Price Transparency When It’s Most Needed

U.S. oil markets are rounding off one of the most volatile and dramatic decades in recent memory. Just since the end of 2014, we’ve experienced two major price downturns as well as a massive shift in global crude trade flows. The U.S. yielded so much oil output that it became the biggest producer globally and […]

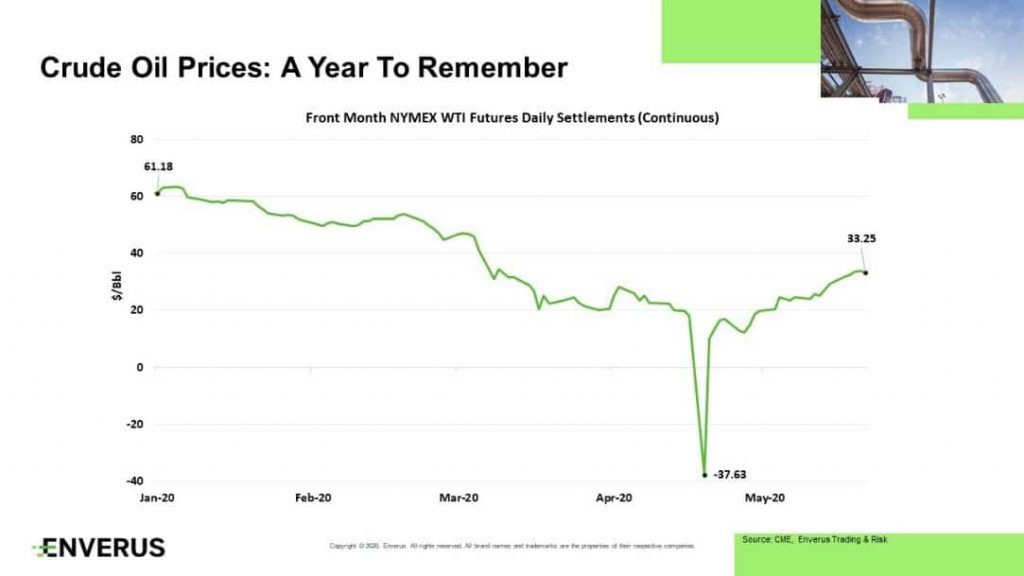

Revived Market Volatility Changes Everything for Risk Analysts

The world is transforming before our eyes. New market realities at play for energy risk managers were unthinkable before the emergence of COVID-19 and risk management has never been more important to energy and commodity traders. From 2020 onward, the people who analyze price risk will throw away their old playbooks. Risk analysts must push […]

How Social Unrest Showed Up in NY Power Loads This Summer

Government-mandated closures aren’t the only thing cutting into power demand in New York this summer. Once the epicenter of the COVID-19 outbreak in the U.S., New York maintained strict closures and travel restrictions throughout April and May. Its shutdowns were swift compared with the rest of the country. As early as March 24, my team […]

Risk Analysts Take Note—High Oil Market Volatility is Here to Stay

2020 has been quite a roller coaster ride—and it’s not even halfway over yet. To be sure, in recent weeks WTI crude reached a little bit of oil price stability compared to what we have been experiencing. But by no means is market volatility in the rearview mirror. In fact, the kind of volatility WTI […]