No, Global Oil Demand Will Not Peak by 2030.

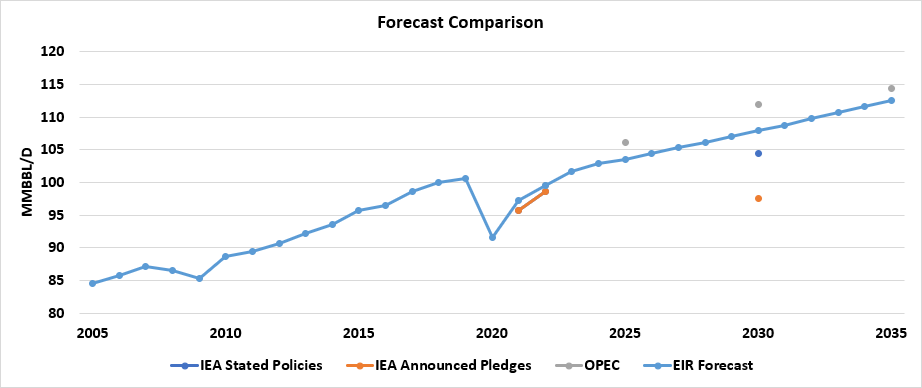

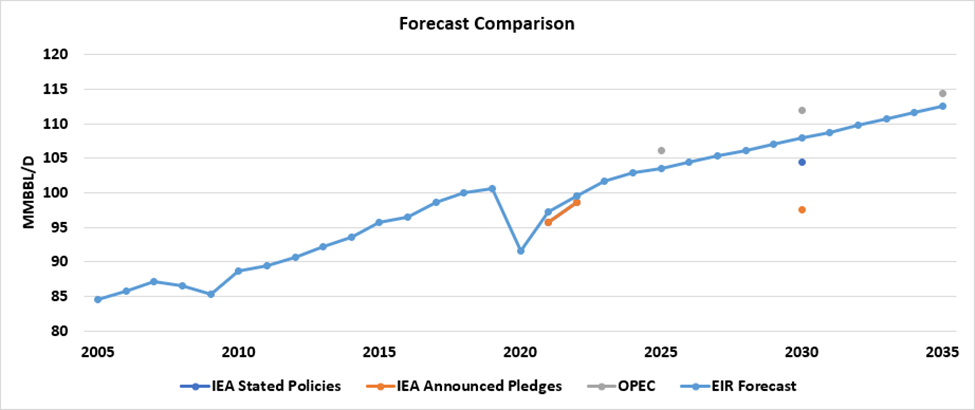

Enverus Intelligence® Research (EIR) holds the position that global oil demand will not peak or decline before the end of this decade. EIR’s analysis offers a distinct and unbiased viewpoint, diverging from the two benchmarks forecasters; OPEC and the International Energy Agency (IEA). The IEA’s most optimistic scenario predicts that global oil demand will stabilize at around 105 million barrels per day by 2030, while scenarios aiming for net-zero emissions propose a significantly lower demand. In contrast, OPEC anticipates an increase to 112 million barrels per day by 2030. Currently sitting at roughly 103 million barrels per day, Enverus Intelligence® Research’s projection points towards a demand of 108 million barrels per day by 2030. This estimate finds a middle ground among the varying predictions, but not by coincidence or through compromise.

EIR has conducted a detailed bottoms-up analysis and found that fuel economy standards aren’t as effective as mandated, while factoring in current electric vehicle sales momentum. Lastly, EIR has adopted consensus estimates for the impact of single-use plastic bans on oil consumption to arrive at our result. Overall, both OPEC and IEA estimates require a significant change in consumption behavior or a reversal of off-oil measures over a short period. History is not in their favor. Our demand forecast results in a world where OPEC’s influence on oil price strengthens, supporting the group’s preference for prices of $85/bbl to $105/bbl. As for when peak demand will occur, we suspect it occurs between 2030 and 2035 as supply costs and availability may combine with off-oil measures to curb consumption in the first half of the next decade.

You must be an Enverus Intelligence® subscriber to access this report.

Why the Discrepancy?

The emerging difference in forecasts stems from varying assumptions about:

- fuel economy standards effectiveness,

- the predicted success of electric vehicle sales,

- and the progression of economic growth to the end of the decade.

To address the conflict between the expected rise in oil demand and the shift towards environmentally friendly technologies and standards, EIR highlights the underwhelming enforcement of fuel economy standards and the slowing momentum towards the adoption of electric vehicles. From an environmental perspective, reaching our goals for net-zero emissions requires reducing oil consumption starting immediately. However, we project an increase in oil demand by 1.5 million barrels per day this year. Although there is a general desire to lower emissions, there appears to be limited willingness to bear the costs or change habits. Overall, current trends suggest that reducing emissions in the transportation sector might not be achievable soon, even with the introduction of recent fuel economy policies in the United States. Yet, future outcomes could be influenced by the leadership of upcoming US Presidents.

On The Persistence of Oil Demand Growth

Fuel economy standards have underwhelmed. Disparities between real-world performance and stated fuel efficiencies, along with a shift towards larger vehicles, have suppressed the gains in fuel efficiency. This discrepancy is likely due to people buying larger vehicles and the fact that the fuel efficiency advertised doesn’t match the actual performance on the road. While government regulations aimed to roughly double fuel efficiencies for new vehicles, their real-world fuel economy seems to fall short of these ambitious goals. Moreover, despite significant increases in electric vehicle (EV) sales in Europe and China, the growth rate in the U.S. has noticeably slowed, affecting its contribution to decreasing global oil demand. Initial enthusiasm around EV sales, driven by substantial growth rates especially in China and Europe, has waned in the U.S., prompting a reassessment of expectations. Current predictions now adjust the forecast for EV sales to account for roughly 25% of total Light-Duty Vehicle (LDV) sales by 2030, a percentage that is less than President Biden’s 50% target. The evidence of this deceleration is apparent in challenges faced by Tesla and Ford’s strategic pivot towards hybrids, which shed light on the U.S.’s diminished appetite for EVs. However, Europe and China continue to display robust momentum in adopting EVs.

Future Outlook of Economies Around the World

The revised prediction regarding the influence of electric vehicles (EVs) on oil demand , along with factors like economic growth and demographic changes, leads to the anticipation of ongoing oil demand. EIR does not predict the significant shifts in per-capita consumption or the decoupling of economic growth from oil consumption that would be necessary to see a peak in oil demand before 2030. To further explain, the well-documented aging populations in China, Japan, and Europe, coupled with the absence of a younger generation to propel economic activity, serve as barriers to increased consumption. However, this is counterbalanced by the demographic upsurge of younger populations in India, Southeast Asia, and Africa, which will shape the regional patterns of oil demand growth into the end of the decade.

EIR’s report author and director, Al Salazar, succinctly states, “Both OPEC and IEA global oil demand estimates require a significant change in consumption behavior or a reversal of off-oil measures over a short period. History is not in their favour. Instead, we believe the rate of demand growth will gradually slow but not peak. However, the regional dispersion of the growth changes dramatically.”

The Implication of Higher For Longer Oil Prices

Al Salazar suggests that EIR’s forecast bolsters OPEC’s sway over oil prices, reinforcing the organization’s preferred Brent crude price range of $85 to $105 per barrel. This scenario, combined with a possible lack of investment in the global oil supply, could set the stage for increases in oil prices, potentially leading to a peak in oil consumption in the early next decade.

While there is widespread agreement on the need to reduce emissions, this has not translated into a decrease in oil consumption. Current projections indicate that oil demand will remain strong at least until 2030. To achieve the environmental goals that have been set, it will be necessary to see significant changes in behavior and a greater readiness to invest in cleaner alternatives.

Authors:

Al Salazar is a seasoned member of the Enverus Intelligence team, bringing over 23 years of experience in the energy industry with a focus on fundamental analysis of oil, natural gas, and power. Throughout his career, Al has held key positions at EnCana/Cenovus and Suncor, where he honed his skills in forecasting, hedging, and corporate strategy. Al’s 15-year tenure at EnCana/Cenovus was particularly impactful, where he contributed significantly to the company’s success. AL earned his bachelor’s degree in Applied Energy Economics from the University of Calgary in 2000, followed by an MBA with honors from Syracuse University in 2007. Al’s academic background, coupled with his extensive professional experience, has equipped him with a deep understanding of the energy industry’s complexities and the necessary skills to navigate them effectively.

Product Marketing Manager at Enverus Intelligence® | Research (EIR) and Trading & Risk

Chris leads the development and communication of the value these products provide various industries, including oilfield services, investment funds, wealth management departments, banks, E&P oil and gas departments, and midstream operators. Chris helps provide customers across the energy ecosystem with the intelligent connections and actionable insights that allow them to uncover new opportunities and thrive.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. EIR is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. Enverus is the most trusted, generative AI and energy-dedicated SaaS company, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Learn more at Enverus.com.