CO2 pipeline economics: The missing link

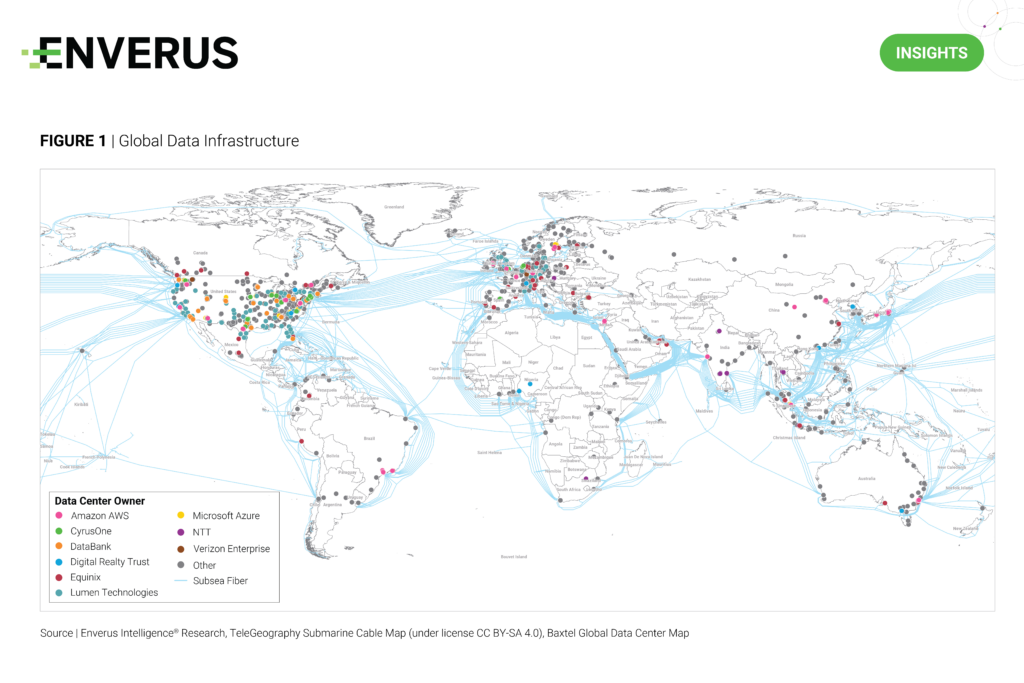

CALGARY, Alberta (April 2, 2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the leading generative AI and energy-dedicated SaaS company, has developed a CO2 Pipeline Economic Model that can be used to analyze transportation economics in the carbon, capture, usage and storage (CCUS) value chain.

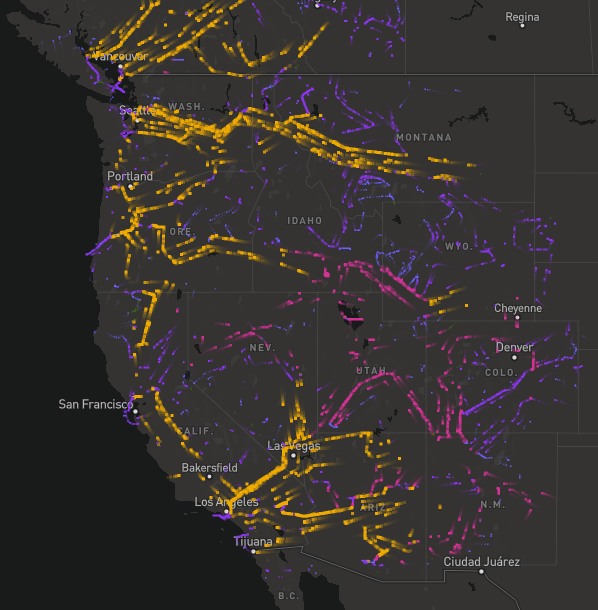

Utilizing the CO2 Pipeline Economic Model, a new EIR report analyzes the differences between CO2 and natural gas pipelines and outlines the importance of minimizing CO2 transportation costs through hub and trunkline pipeline designs. For example, EIR has used the model to analyze the canceled Navigator CO2 Heartland Greenway project economics to illustrate the hub-scale economics the project was targeting.

“With carbon capture gaining momentum as a method to lower emissions, many industries still face challenges in terms of economic viability for the entire capture and storage value chain,” said Jeffery Jen, senior associate at EIR.

“A key component of the overall cost and ultimate success of these projects will be their transportation strategies — whether they can leverage trunkline designs to connect to higher-quality storage reservoirs and reduce transportation and storage costs,” Jen said. “EIR calculates that projects should target bundled captured emissions of 12-18 million tonnes per annum (mtpa) as part of their transportation strategies to minimize transportation costs and maximize profitability.”

Key takeaways:

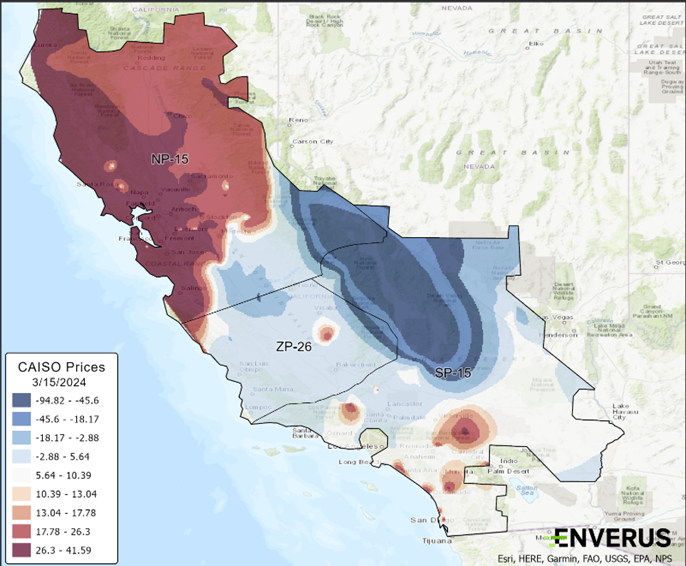

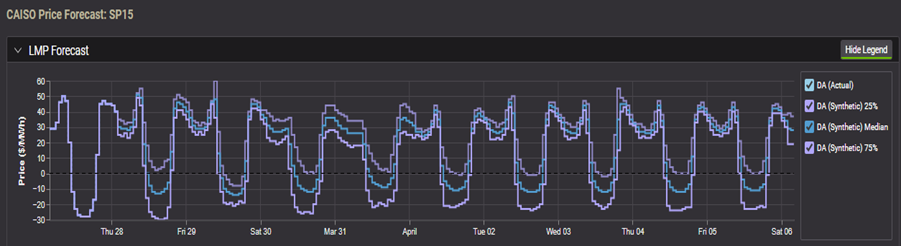

- Only 290 mtpa, or 13%, of U.S. emissions break even below $85/tonne assuming top decile storage costs. Developing transportation strategies that utilize trunkline design to maximize flow rate while connecting emitters to higher-quality reservoirs will be a key strategy for profitable CCUS projects.

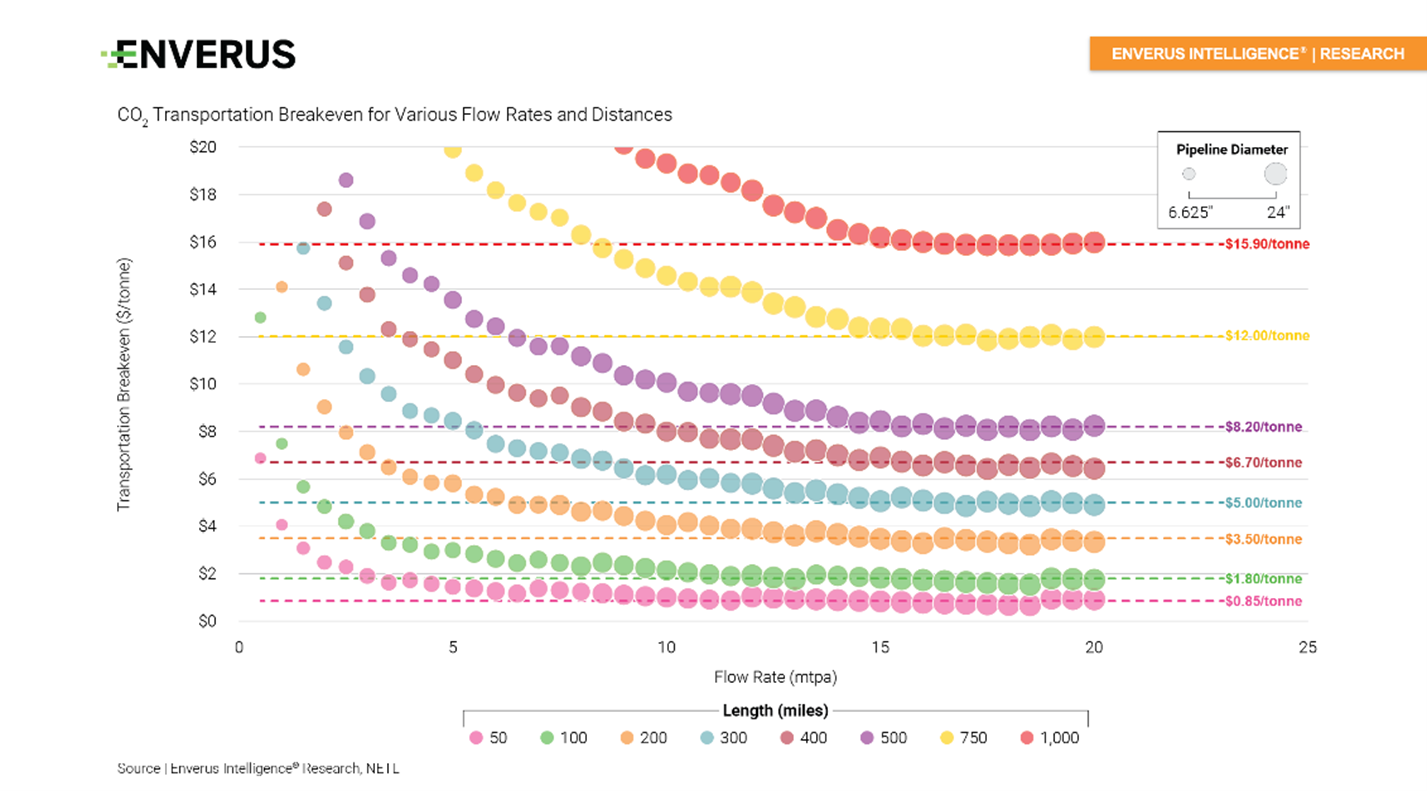

- The CO2 transportation breakeven ranges from $0.85-$15.90/tonne, contingent on optimal flow rates of 12-18 mtpa.

- Labor and materials constitute 50% of the CO2 transportation breakeven, creating cost escalations more than 10 times caused by locational disparities in labor costs, access to materials and terrain variability.

- The canceled Navigator CO2 Heartland Greenway project showed cost savings of almost 10 times through the utilization of a trunkline design. The CO2 transportation breakeven would have been under $10/tonne with 15 mtpa of capacity.

- With the addition of the CO2 Transportation Economic Model, EIR can now model the economics of the entire CCUS value chain.

EIR’s analysis pulls from a variety of Enverus products including Energy Transition Research and Enverus Infrastructure.

You must be an Enverus Intelligence® subscriber to access this report.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. EIR is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. Enverus is the most trusted, generative AI and energy-dedicated SaaS platform, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Learn more at Enverus.com.

Media Contact: Jon Haubert | 303.396.5996

View all press releases at Enverus.com/newsroom.